This section is presented

This section was created by the editors. The client has not been given the opportunity to limit or revise the content prior to publication.

by TD Insurance

Links to breadcrumbs

Personal Finance Family Finance

Amy’s first step is to improve her tax efficiency, says expert

Ten years ago, Amy made a major investment in an RRSP-eligible mortgage company that encouraged savers to dive deep into their savings. Photo by Gigi Suhanic/National Post photo illustration

Ten years ago, Amy made a major investment in an RRSP-eligible mortgage company that encouraged savers to dive deep into their savings. Photo by Gigi Suhanic/National Post photo illustration

Reviews and recommendations are unbiased and products are selected independently. Postmedia may earn an affiliate commission for purchases made through links on this page.

Article content

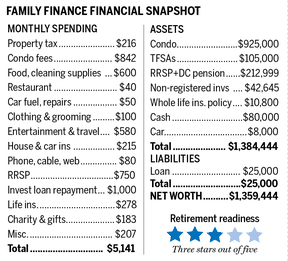

In Ontario, a woman we’ll call Amy, 57, works for a community organization. She has no dependents and only one $25,000 debt that was used to buy an investment. Her financial goal is a sustainable income of $40,000 a year — or $3,333 a month — after taxes when she retires at age 60. That’s roughly her current expenses minus savings and loan repayments.

Advertisement 2

This ad hasn’t loaded yet, but your article continues below.

Article content

Family Finance asked Derek Moran, head of Smarter Financial Planning Ltd. in Kelowna, BC, to work with Amy. He notes that she has $1,384,444 in total assets, including her apartment. That amount includes $451,444 in financial assets, including $80,000 in cash. Her net worth is $1,359,444. Her investment portfolio is largely a list of high-fee, mostly fixed-income mutual funds.

Article content

Email andrew.allentuck@gmail.com for a Free Family Finance Analysis

Ten years ago, Amy made a major investment in an RRSP-eligible mortgage company that encouraged savers to dive deep into their savings. She placed a big bet on the company and lost $211,000, which was 70 percent of the value of her RRSP at the time.

“I knew the number of properties was skyrocketing and it seemed like a way to get in,” she recalls. She bet on something she thought was certain. The only thing that was certain was the fat incomes for investment managers and salespeople. Her response was to invest in low-yield assets that do not accelerate inflation.

Advertisement 3

This ad hasn’t loaded yet, but your article continues below.

Article content

Current investments

Today, Amy has a monthly budget of $5,141, of which $1,750 goes toward savings and paying off an investment loan. That leaves real spending at $3,391 per month or $40,692 per year. To generate that after-tax amount, Amy would need $48,000 a year before taxes.

The first step for Amy is to improve her tax efficiency. She has $104,954 in RRSP contribution space. She generates another 18 percent of the salary for RRSP space, which works out to $17,159 per year. For four years, that works out to $68,636. Combined with her current RRSP room, she can add as much as $173,590 without contributing too much. She can get a 30 percent tax refund on all RRSP contributions she makes on the job, but probably won’t have to pay more than 15 percent in taxes when she retires the money.

Advertisement 4

This ad hasn’t loaded yet, but your article continues below.

Article content

She also has a source of money in a life insurance policy with a face value of $50,000 and a cash value of $10,800. She has no children to leave money to, so she can cash the policy and use the cash value for the RRSP or donate the policy to charity for a tax benefit. Her current expenses include $278 per month for lifetime coverage.

Sources of Retirement Income

We estimate that Amy will receive 90 percent of the current maximum CPP benefit of $15,043, net $13,500 per year. She also gets full age protection, currently $7,707 per year.

Her TFSA has a current balance of $105,000. The TFSA balance, which grows at three percent per year after inflation, will be $118,178 in 2022 dollars when she turns 60. Spend in the next 30 years up to age 90, that amount would support spending of $5,979 per year.

Advertisement 5

This ad hasn’t loaded yet, but your article continues below.

Article content

Amy’s RRSP and LIRA, including her work-based defined contribution plan, total $212,999.

Amy’s goal should be to use the RRSP to reduce her taxable income to $49,020, which is the top of the first federal tax bracket. In this way she optimizes her tax refund. Part of the contribution could be deferred and withheld next year, Moran explains. Refunds can go back to her savings.

A kitchen reno put a dent in this Alberta teacher’s TFSA. Now she has to catch up for her retirement

Dad awards more than $675,000 in costs after epic five-year battle over children

Ontario woman needs to get rid of real estate and debt to meet her retirement income goal

If Amy contributes all of the monthly savings, $1,750 plus $397 from her employer, for a total of $2,147 per month or $25,764 per year over four years, plus $70,000 from her current cash reserves, the RRSP will have risen to about $430,000. If she also contributes the $66,000 in tax refunds she generates during that period, she will be left with nearly $500,000.

Advertisement 6

This ad hasn’t loaded yet, but your article continues below.

Article content

Those funds that grow at three percent per year for the next 30 years support taxable income of $25,096 per year.

Before age 65, Amy has TFSA cash flow of $5,979 per year and RRSP income of $25,096, totaling $31,075. After 12 percent average tax excluding TFSA income, she has $28,060 per year to spend. She would fall significantly short of her after-tax target income. Options for closing the gap included working part-time or downsizing her $1 million apartment to a $500,000 unit and using cash, say $12,000 for five years to age 65, to stay in the black. It would allow it to increase its financial assets and their income generating potential.

Exchange property for income

Rebalancing to make her home, a smaller apartment perhaps, only a third of its total assets would free up value for investment, especially stocks that pay solid dividends of three percent to four percent a year, issued by companies with a history of higher payouts. Lists of these dividend aristocrats are readily available online.

Advertisement 7

This ad hasn’t loaded yet, but your article continues below.

Article content

The proceeds from the sale of apartments would be reduced by preparation and sale costs at five percent of value, but the remaining $878,750 less $500,000 for new excavations would be left with $378,750 for expenses and investments. Invested at three percent post-inflation, the permanent income from that capital would be $11,362 per year or $947 per month. Her total annual income would rise to about $42,400 before tax. After 13 percent tax, that would leave her about $37,675 a year or $3,140 a month. She would still be below par. Working part-time would close the gap to her after-tax goal of $40,000.

Once she’s 65, Amy can add $13,500 CPP per year and $7,707 OAS for a total estimated annual income of $52,282. After 15 percent, she would have $45,337 to spend each year. That’s $3,780 per month. Amy would exceed her monthly retirement goal of $3,333 after tax.

3 pension stars*** out of 5

email andrew.allentuck@gmail.com for a free Family Finance analysis

Share this article in your social network

Advertisement

This ad hasn’t loaded yet, but your article continues below.

Top Financial Messaging Stories

By clicking the sign up button, you agree to receive the above newsletter from Postmedia Network Inc. receive. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc. † 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for signing up!

Comments

Postmedia is committed to maintaining a lively yet civilized discussion forum and encourages all readers to share their thoughts on our articles. It can take up to an hour for comments to be moderated before appearing on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update to a comment thread you’re following, or a user follows comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

This post This Ontario woman may have to downsize, work part-time to meet her retirement goals

was original published at “https://financialpost.com/personal-finance/family-finance/this-ontario-woman-may-need-to-downsize-work-part-time-to-meet-her-retirement-goals”