You have many different options for placing your money, and how you allocate your cash and other liquid assets can make a difference to your overall financial health. While previous generations may have only had the option of a checking or savings account at the local bank, there are now many different options. Neobanks are a relatively recent invention that you may want to consider when looking for the best asset allocation for your situation.

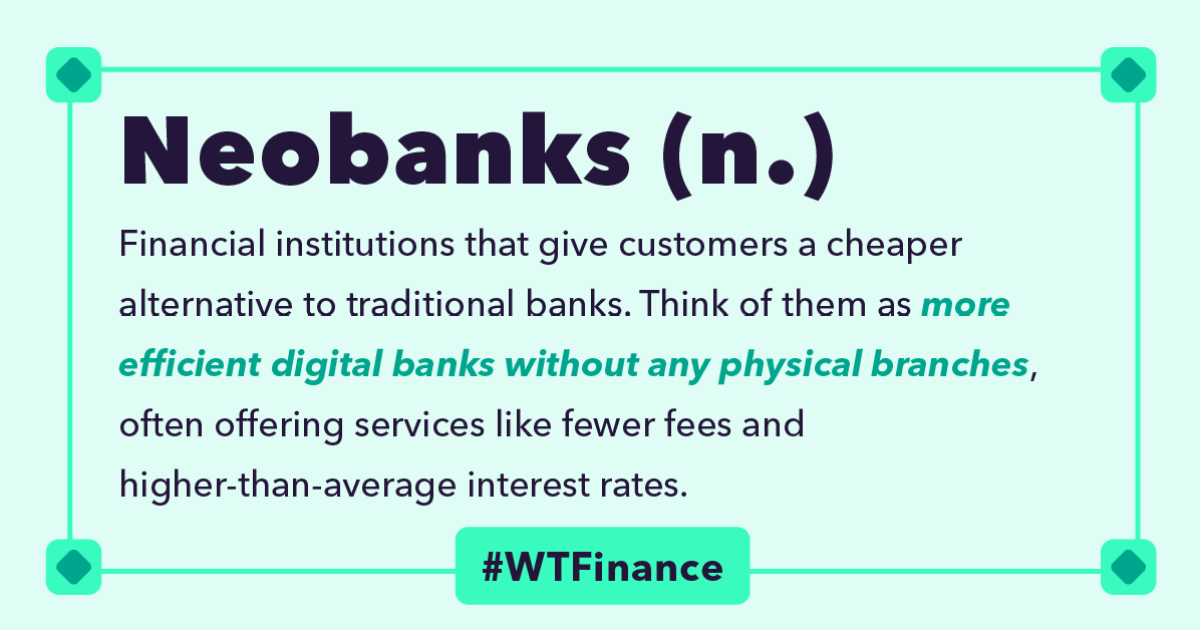

What is a Neobank?

A neobank is a fintech company that offers many of the same features as traditional banks. Usually, a neobank specializes in specific types of financial accounts or transactions, such as checking or savings accounts. Most neobanks are app-based and completely online, with no physical branches. This helps keep costs down, sometimes allowing neobanks to offer lower interest rates or higher savings rates.

Some popular neobanks are:

A SoFi Chime Varo Bank Current GO2Bank Mercury

What is the difference between a Neobank and an online bank?

The main difference between a neobank and an online bank is that, despite the name, a neobank is not a bank. That means they typically don’t have a bank charter, although most deposits with neo banks are typically FDIC-insured. An online-only bank (such as Ally Bank or Discover Bank) has a bank charter and is officially a bank, only with no physical locations.

Neobanks also typically offer fewer features than traditional or online banks. So if you are looking for different types of financial products, you may be better off with a more traditional bank. But if you’re just looking for a basic checking or savings account, it might be a good idea to consider a neobank.

Another way neobanks differ from online banks or more traditional banks is the way they make money. Most neobanks make their money from the interchange fees charged when customers use their debit card. Because they are smaller than most traditional banks, they can charge higher rates for their interchange fees.

Are Neobanks safe?

As we mentioned before, the money deposited with most neobanks is FDIC insured, although you want to make sure of that before depositing money with a neobank. Standard FDIC insurance is $250,000 per bank, per account type. So unless you have a huge amount of money in a particular neobank, you don’t have to worry about the safety of your money.

Almost all neobanks also use the highest level of security and encryption for their apps and online sites. As long as you stick with a relatively well-known and reputable neobank, you should feel just as comfortable interacting with their site as you would with a major retailer or other major online site.

Pros and Cons of Neobanks

Here are some of the pros and cons of neobanks:

Pros Cons Lower costs — Since neobanks do not have the higher costs of traditional banks (including physical branches), they often have lower costs. They are not actually banks – Neobanks generally do not have a bank charter, so they are not bound by the same rules as banks. More Convenient – It can be fun to deposit checks, check balances, and do other banking functions without having to enter a bank. No in-person branches — You communicate online or through the mobile app — neobanks usually don’t have physical locations Often faster — It can often be faster to open an account and perform other banking transactions with a neobank. Fewer Services Offered — Most neobanks offer only a few basic services, such as checking and saving accounts. Better rates — Because neobanks typically have lower rates, they can offer higher interest rates on savings accounts and lower interest rates on loans.

It comes down to

You have plenty of choice where and how you deposit your money. There are pros and cons to using a traditional bank, an online bank, or a neobank. It is important to understand what a neobank is and how it works to know if it is right for you. Neobanks offer many similarities to traditional banks, but have no real banking charter. This means that they are not subject to the same rules and regulations as traditional banks. But if you’re just looking for basic checking and savings accounts, a neobank might be for you. Check out the pros and cons of using a neobank and decide if it makes sense for you.

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top.

Learn more about security

![]()

Dan Miller (97 posts)

Dan Miller is a freelance writer and founder of PointsWithACrew.com, a site that helps families travel for free/cheap. His home base is in Cincinnati, but he tries to travel the world as much as possible with his wife and 6 children.

Left

This post Everything you need to know about Neobanks

was original published at “https://mint.intuit.com/blog/wtfinance/everything-you-need-to-know-about-neobanks/”