Being aware of your finances makes financial mistakes smaller and smaller. But tax filing only happens once a year, and it’s easy to make mistakes that lead to the IRS overpaying. When that happens, filers have the option to correct their mistakes by filing IRS Form 1040-X. Once the amended return is processed, the IRS reduces overpaying taxpayers an additional refund check.

If you’ve ever made a mistake on your tax return, you may have the opportunity to correct it. We dive into how to file an amended tax return.

What is changing a tax return?

Changing a tax return is correcting a tax return that you have already filed. Most people choose to file an amended tax return when they realize they could get a larger refund based on a mistake they made during the filing process. Some people have to file amended returns based on IRS filings. These types of changes usually come with taxes due.

The IRS allows people to correct their mistakes (and get the money they overpaid) by filing IRS Form 1040-X.

In general, to correct problems with your tax return, you must file an amended return within three years of the date you originally filed your return or two years from the time you paid the taxes for that year. If you paid your 2019 tax return on March 1, 2020, you have until March 1, 2023 to submit an amended return.

Why do you need to change your tax return?

The main reason for amending a return is to correct an error that affects the amount of tax owed in a given year. An amended return could result in you being charged additional taxes or getting a larger refund.

Some key issues likely to affect the amount owed include:

Incorrect submission status. Claiming the incorrect number of dependents.

Changes in your total income (including deductions from business income if you forgot to deduct legitimate business expenses).

Claiming tax deductions or credits that you did not claim originally.

In rare cases, the IRS will also issue tax law amendments very late (or even retroactively) that make you want (or need to) change your tax return. This has become more common in recent years.

When do you submit your amended tax return?

You have three years from your original filing date to file an amended return. You don’t want to spend months with it, but you also don’t want to file a tax return too early.

The IRS warns that people who expect a refund on their original tax return should not file an amended return until they receive the expected refund. For example, if you’re one of the unlucky few still waiting for a tax refund from 2020, you’ll have to wait until you get it before changing your taxes.

Change a tax return?

Just as we recommend using tax software to file your regular tax return, we recommend using tax software to file your amended return. The only way to file your amended tax return electronically is to use a tax software product.

Every tax software has slightly different steps, but these are the general steps to follow to amend your tax return.

Step 1: Collect the right documents

To file your amended return, you will need your original return and any documents supporting the change of return. To get your original tax return, you can either access the return through your tax software (usually you can access it for a year or more) or you can get your tax statement from the IRS.

Aside from your original return, you will need documents that support the change you are making to your tax return. For example, a parent who claims an extra child as a result of a guardianship arrangement needs proof of the final settlement.

Those claiming forgotten credits or deductions may require receipts to support the claim. If you forgot to claim a portion of your income, you will likely need a 1099-NEC, W2, or other 1099 source to support the change.

Step 2: Choose how you want to archive your 1040-X

It is theoretically possible to prepare and ship a 1040-X by hand. However, we recommend using a CPA or tax software to do the heavy lifting for you.

Filers who have used a CPA for the tax year they are changing should talk to their CPA about the cost structure. You may be able to engage the CPA to file an amended return at no cost or at a limited cost, especially if the CPA should have taken care of the problem.

If you choose to use tax software, we generally recommend that you use the software you originally used to file your tax return. For example, if you used FreeTaxUSA to file your 2019 tax return, you must use FreeTaxUSA to amend your 2019 tax return.

Step 3: Complete the 1040-X

To complete your amended return, you must follow the instructions of the tax software product you choose. These are instructions from some of the most popular tax companies.

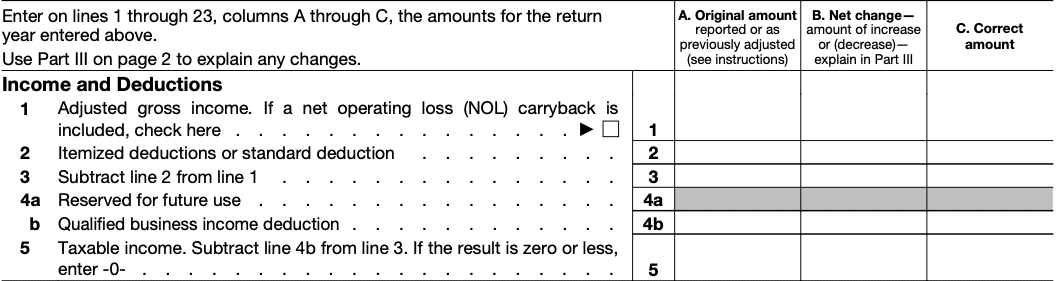

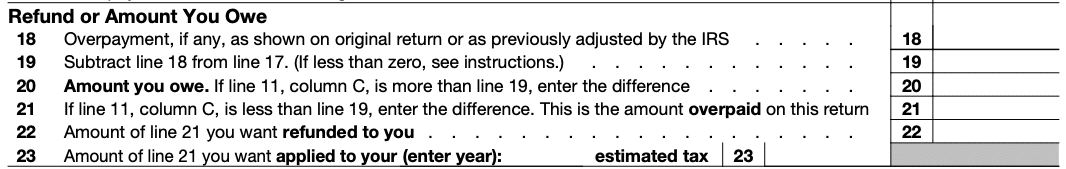

Form 1040-X has only three main columns to fill out. Column A shows the amount you originally reported on your 1040. Column B shows the net changes (both positive and negative) and C the correct amount.

After you have entered the basic details of your income and deductions, you can easily calculate the correct refund amount.

Most major tax software offers step-by-step guidance to help filers accurately complete their amended returns. The software asks questions about what has changed so that users can more accurately resubmit their information.

Step 4: Submit the 1040-X with supporting information

The IRS supports e-filing using tax software products such as the software mentioned above. Filers can currently file returns for tax years 2019 through 2021 electronically. The IRS does not allow filers to submit forms they have completed by hand electronically.

People who want to complete their 1040-X without tax software must mail their return and supporting documentation to the IRS. People who choose to change their declaration themselves can email it to:

financial department

tax authorities

Austin, TX 73301-0215

If you change your return based on instructions from the IRS, mail the return to the address listed in the official IRS report.

Remember, you must file IRS Form 1040-X and any amended schedules or forms that support the amendment.

Step 5: Track the status

You can follow the status of your amended return via the website of the Tax Authorities. During peak tax return season, it can take 16 weeks or more for amended returns to be processed. Unless there was a mistake with your return, the IRS will eventually refund your money to you.

Final Thoughts

It can be frustrating to hear that you left money on the table by making a mistake with your taxes. But the IRS allows tax applicants to reclaim the money that is legitimately theirs. You probably don’t want to spend your Saturday afternoon filing preparation, but it could lead to an additional refund of hundreds or even thousands of dollars.

While filing is a hassle, getting the money owed to you is probably worth it.

This post Submit an amended tax return?

was original published at “https://thecollegeinvestor.com/39602/how-to-file-an-amended-tax-return/”