Links to breadcrumbs

Taxes Personal Finances

Jamie Golombek: Ottawa says some high-income Canadians still aren’t paying enough income tax and are reviewing alternative minimum tax

Ottawa is reviewing the Alternative Minimum Tax (AMT), the results of which will be released in the fall economic update. Photo by Getty Images/iStockphoto

Ottawa is reviewing the Alternative Minimum Tax (AMT), the results of which will be released in the fall economic update. Photo by Getty Images/iStockphoto

Reviews and recommendations are unbiased and products are selected independently. Postmedia may earn an affiliate commission for purchases made through links on this page.

Article content

One of the more curious items in last week’s nearly 300-page federal budget was an ominous statement that “some high-income Canadians still pay relatively little personal income tax as part of their income.”

Advertisement 2

This ad hasn’t loaded yet, but your article continues below.

Article content

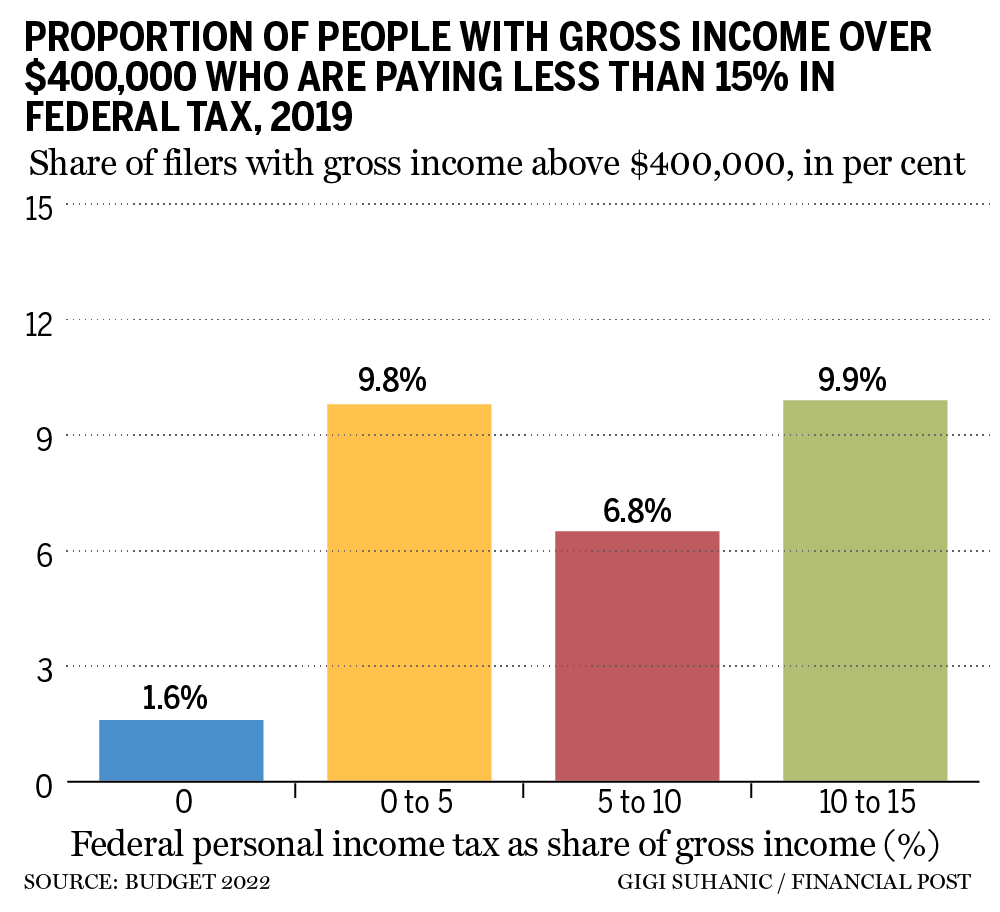

The budget paper provided some statistics, using 2019 tax data, showing that 28 percent of filers with gross incomes over $400,000 (which was the top 0.5 percent of all income earners), or about 41,400 individuals, had a average federal tax rate of 15 percent or less by taking advantage of various tax deductions and tax credits. In more detail, the data shows that nearly 18 percent of those top earners (about 27,000 Canadians) paid less than 10 percent in federal taxes. And apparently 1.6 percent (2,400 filers) paid zero federal tax.

The data was published as a way to introduce the government’s revision of the alternative minimum tax (AMT), the results of which will appear in the fall economic update. But are these numbers actually a concern? Is there anything outrageous about such a low effective rate? Or taxpayers simply follow the law in accordance with the widely accepted principle of the Duke of Westminster which states that “taxpayers have the right to manage their affairs to minimize the amount of tax payable.” Based on a 1936 tax case in the United Kingdom, this principle was last confirmed by the Supreme Court of Canada in a November 2021 decision.

Advertisement 3

This ad hasn’t loaded yet, but your article continues below.

Article content

It is a question worth investigating. For starters, keep in mind that the budget stats looked only at the federal tax rate and not the combined federal/provincial rate. Currently, there are five federal tax brackets for 2022: zero to $50,197 income (15 percent); over $50,197 to $100,392 (20.5 percent); above $100,392 to $155,625 (26 percent); over $155,625 to $221,708 (29 percent); and anything above $221,708 is taxed at 33 percent.

Because of the gradual, progressive rates on the first $221,708, the 2022 federal tax on $400,000 in ordinary income would be about $109,000 for an average federal tax rate of about 27 percent, before taking into account tax-preferred income and various other deductions. and credits .

Advertisement 4

This ad hasn’t loaded yet, but your article continues below.

Article content

Capital gains are only 50 percent taxable, meaning that a person who makes a one-time profit on the sale of their home of, say, $400,000, would have a gross income of $400,000, but a taxable income of $200,000, because only half the profit is taxable. Without any other income, the federal tax bill would be about $43,000 and the average federal tax rate would be 10.8 percent on capital gains. But is the cottage seller, who had a very high income for a year, really a “high income” earner for which the government should charge an AMT?

A quick look at the Canada Revenue Agency’s 2019 revenue stats for the 2017 tax year (the most recent publicly available data) shows that 51 percent of the top income earners (defined for these metrics as those earning more than $250,000) , about 312,000 Canadians, reported a taxable capital gain, averaging just over $125,000, which would likely mean the average capital gain was about $250,000.

Advertisement 5

This ad hasn’t loaded yet, but your article continues below.

Article content

Next, let’s look at an investor making $400,000 in Canada-eligible dividends. Because of the dividend tax credit, equal to 20.73 percent of the dividends actually received, the federal tax on $400,000 in eligible dividends would be only $76,000 for an average federal tax rate of 18.9 percent, which is also the median tax rate of the United States. expected rate. Two-thirds of the top earners in 2017 reported some Canadian dividends, averaging over $100,000.

Of course, tax deductions can also lower your average tax rate. The top three deductions (in total dollar value) claimed by the highest earners in 2017 were the Registered Retirement Savings Plan (RRSP) deduction, Lifetime Capital Gains Exemption (LCGE), and the Employee Stock Option Deduction.

Advertisement 6

This ad hasn’t loaded yet, but your article continues below.

Article content

Canada Revenue Agency data for 2017 shows that 60 percent of top earners claimed an RRSP deduction (average claim of $38,730, meaning some taxpayers were clearly catching up on the unused RRSP contribution margin). And while the employee stock option deduction was taken by just four percent of the highest-income earners, the average deduction was nearly $152,000. (This is likely to decrease in the coming years, as the rules limiting the benefits of the stock option deduction have changed as of July 1, 2021).

Jamie Golombek: This is how the federal budget affects your wallet

Jamie Golombek: What tax changes are coming to the federal budget?

You can better check your tax return if you have used the CRA’s auto-completion

You have questions about the exemption from primary residence from the CRA, we have answers

Advertisement 7

This ad hasn’t loaded yet, but your article continues below.

Article content

In 2022, the LCGE eliminates taxes on $913,630 in capital gains from the sale of qualifying small business stock, and $1 million in capital gains on the sale of qualifying agricultural or fishing properties. The CRA data shows that nearly 18,000 of the highest-income taxpayers in 2017 claimed LCGE deductions worth $4.6 billion, with an average claim of approximately $260,000, which is the equivalent of $520,000 in tax-exempt capital gains . This will likely explain the zero rate for some taxpayers in the 2022 budget document.

Finally, on the credit side, there are charitable donations. A high-income earner who makes a large donation of, say, $100,000 to charity would be entitled to a 33 percent federal gift tax credit. The tax payable on $400,000 after considering the gift discount for a $100,000 gift would be approximately $75,000 for an average federal tax rate of 18.9 percent. The CRA data shows that 64 percent of the highest-income earners reported a charitable donation in 2017, with an average donation of $17,389. Charitable donations can significantly lower your average tax rate, depending on the amount.

Advertisement 8

This ad hasn’t loaded yet, but your article continues below.

Article content

We already have a federal AMT with a 15 percent rate. If the government is to retain the full benefits of charitable giving, the integration must remain intact by allowing the dividend tax credit designed to minimize the double taxation of corporate income, and the lower capital gains withdrawal rate or the LCGE on the one-time sale of a cottage, business, or farm or fish estate, there’s very little tax revenue to reap in an updated AMT, especially given the changes already made to employee stock options last year.

Jamie Golombek, CPA, CA, CFP, CLU, TEP is the General Manager, Tax & Estate Planning at CIBC Private Wealth in Toronto. Jamie.Golombek@cibc.com

†

Sign up for the FP Investor newsletter for more stories like this.

†

Share this article in your social network

Advertisement

This ad hasn’t loaded yet, but your article continues below.

Top Financial Messaging Stories

By clicking the sign up button, you agree to receive the above newsletter from Postmedia Network Inc. receive. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc. † 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for signing up!

Comments

Postmedia is committed to maintaining a lively yet civilized discussion forum and encourages all readers to share their thoughts on our articles. It can take up to an hour for comments to be moderated before appearing on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update to a comment thread you’re following, or a user follows comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

This post CRA data shows little gain in raising minimum tax for top earners

was original published at “https://financialpost.com/personal-finance/taxes/cra-data-show-theres-little-to-gain-from-increasing-the-minimum-tax-on-top-earners”