A finance app designed with you in mind can be hard to find. That’s especially true if you need to regularly exchange currencies or send money internationally.

But Revolut might just be the money management platform you’ve been waiting for. Revolut built a cross-border finance app to help you manage your finances seamlessly.

Let’s take a closer look at Revolut and the features and benefits it offers to its US customers to see if this mobile app is right for your financial needs.

![]() Comprehensive app designed to meet your financial needs Easy and affordable international exchange features Savings safes are designed to help you meet your savings goals

Comprehensive app designed to meet your financial needs Easy and affordable international exchange features Savings safes are designed to help you meet your savings goals

Free international transfers

What is Revolution?

Nik Storonsky and Vlad Yatsenko launched Revolut in 2015. Since its inception, the company has grown to provide financial services to more than 18 million personal users. In addition, Revolut has more than 500,000 business users worldwide.

As of early 2022, the company will support users in more than 35 countries with more than 28 currencies available within the app. In the app you will find tools to help you plan daily expenses, savings strategies and additional features that fit your financial goals.

Revolut expanded to the US from early 2020 and the fast-growing financial super app continues to add features for their US customers. While Revolut itself does not store your money, it works with FDIC-insured partner banks to store your money. You’ll probably find that most of your favorite money management features are built right into the Revolut platform.

What does it offer?

Ready to see what this self-proclaimed financial super app has to offer? Here’s what you need to know.

International money transfers made easy

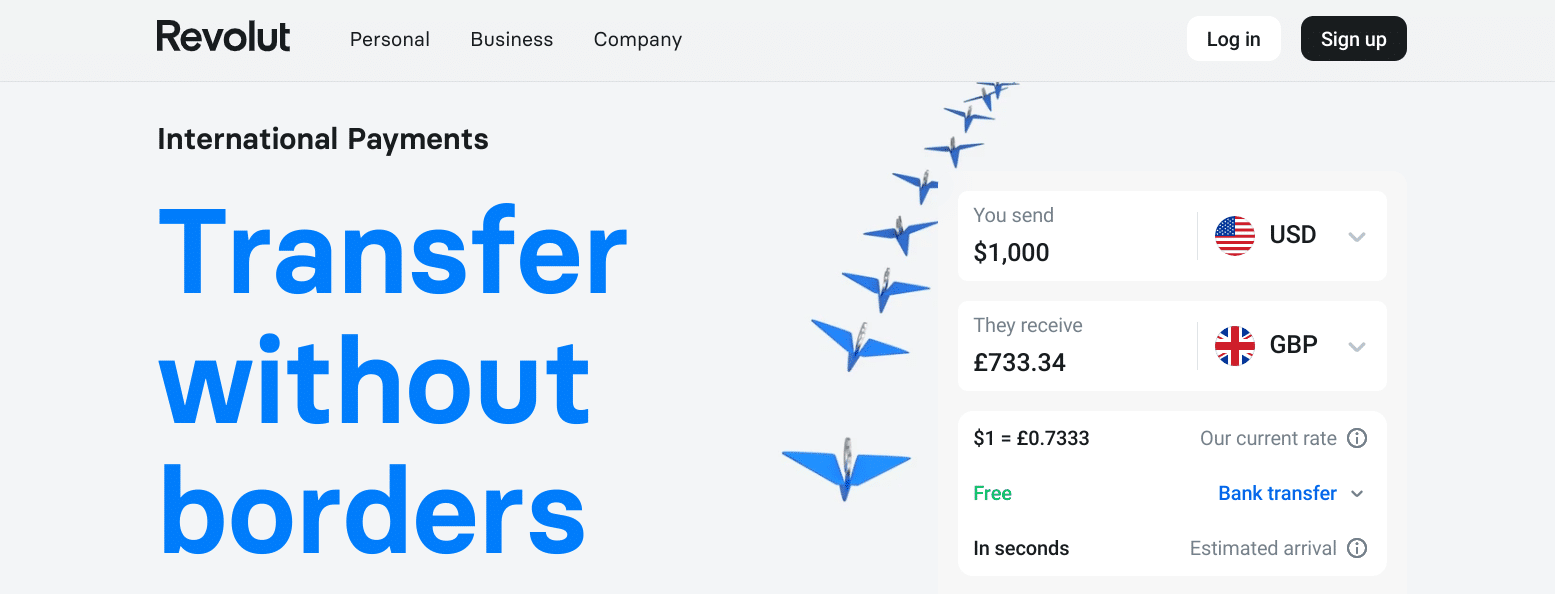

Transferring money internationally can quickly become expensive. But not if you’re working with Revolut. The money can be sent in more than 28 fiat currencies. And the best part is that you don’t always have to pay a transfer fee!

As a Revolut user, you can get 10 free international transfers every month (applicable only to customers with the Standard Plan, Premium Plan and Metal Plan).

In addition to simple international transfers, you can also exchange money directly in the app. Instead of paying a bizarre fee on the spot, Revolut users can comfortably take advantage of a reasonable exchange rate on their smartphone.

Seamless savings

Revolut allows you to set up ‘lockers’ for different savings purposes.

Once a vault is set up, you can fund it by rounding up your loose change, making a standing order, or adding cash periodically. The great thing about these vaults is that Revolut gives you plenty of ways to build your savings.

You can even choose to set up a group vault with friends or family to save together for a great cause. And in a truly international friendly way, you can store your savings in over 28 different currencies.

Unfortunately, the returns Revolut offers are not exciting. Savings vaults offer interest rates much lower than you can get with some of the best high-yield savings account options today.

Built-in budget tools

When using Revolut, there are budgeting tools to help you stay on track. Revolut even helps you build a budget based on your spending forecasts and savings goals.

If you are close to spending too much money, Revolut will send you an alert. Every week you will receive an overview of your spending pattern to see where you need to make improvements.

Crypto Options

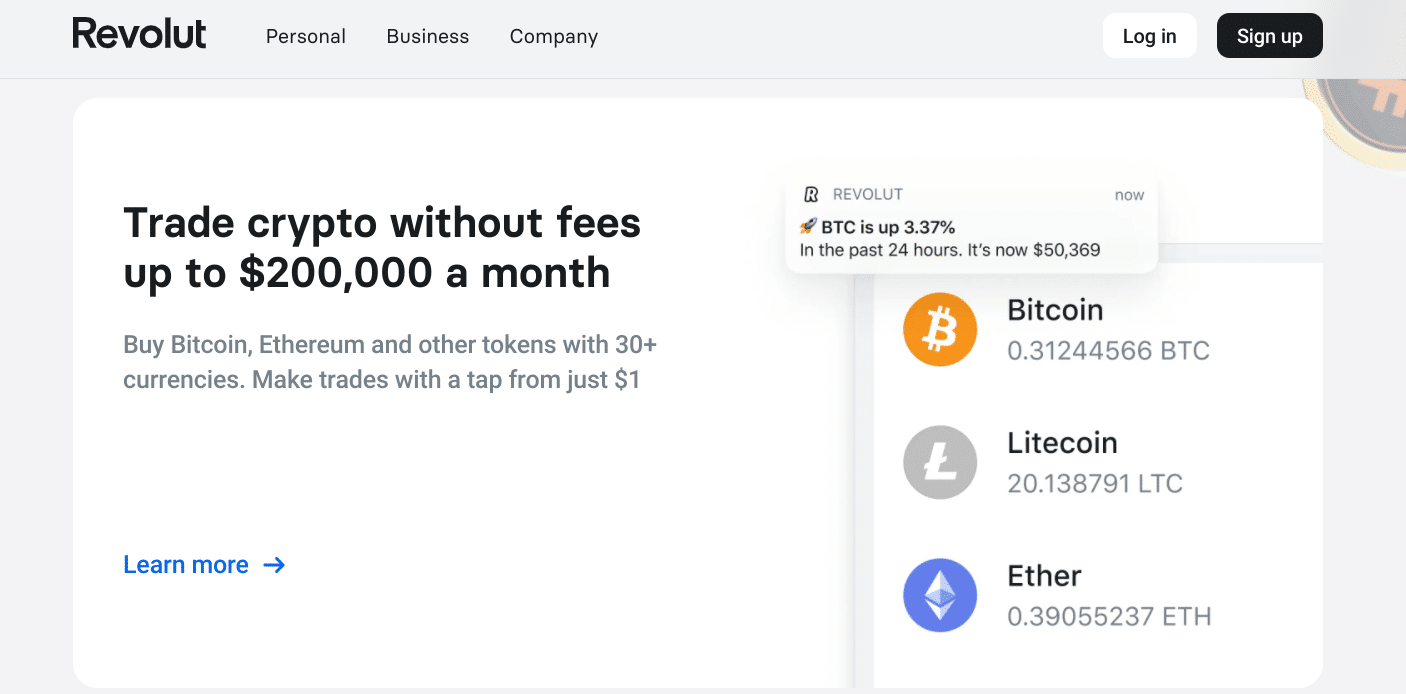

If you want to buy cryptocurrency, you can do so directly in the Revolut app. Buying, selling and trading cryptocurrency within the app is absolutely possible. Beyond that, you can trade up to $200,000 in crypto per month without paying any commission fees.

You even have the option to round up your loose change to buy cryptocurrency.

Revolut currently supported 60 different cryptocurrencies. The asset list includes not only major coins such as Bitcoin and Ethereum, but also a large number of popular altcoins such as Dogecoin, Compound, Sushi, Solana, Decentraland, and Uniswap.

All crypto fees and features mentioned in this article are for US customers only. Revolut’s cryptocurrency services in the US are provided directly by Paxos Trust Company. As a reminder, keep in mind that cryptocurrencies are not FDIC or SIPC Insured and investments in cryptocurrencies can lose value.

Are there any costs?

Yes, Revolut offers three different price points for users to consider. Among which:

Default

The Standard Package is free. With this you can:

Get a free Revolut cardSpend in over 140 currencies at the market exchange rate Exchange in over 28 fiat currencies for up to $1,000 with no hidden feesNo Revolut fees for out-of-network ATM fees for up to $1,200 in withdrawals per month

100% free cash withdrawals from more than 55,000 ATMs in the network

Trade commission-free in cryptocurrencies up to $200,000 per month

Earn 0.05% APY on savings

Revolut Junior account for up to 5 children

10 free international transfers per month

Premium

The Premium option costs $9.99 per month. In addition to the above features, Premium adds the following options:

Exchange in 28+ fiat currencies for an unlimited amount of money at no costOverseas health insurance optionGlobal express deliveryPriority customer supportEarn 0.07% APY on savingsPremium cardDisposable virtual cardsLoungeKey Pass access

Metal

The last and most expensive option is the metal packaging. With a price of $16.99 per month, you can access these additional features:

Delayed Baggage & Delayed Flight InsuranceExclusive Revolut Metal Card

And of course, Metal members have access to all the features available to Premium or Standard users.

How does Revolut compare?

Revolut is certainly not the only finance app out there. However, Revolut offers extensive international features that will appeal to many around the world.

If you don’t need to exchange currencies regularly, there are other good options for finance apps. But you are missing out on the opportunity to have your cryptocurrency portfolio in the same place as your savings.

Here’s a quick look at how Revolut compares to two other popular cross-asset platforms, Uphold and Wirex.

How do I open an account?

Do you want to use Revolut? The process starts by downloading the app in the app from the Apple App Store or Google Play Store. Once the app is installed, you’ll need to provide Revolut with some basic information.

While there are some details that need to be handed over, the process is very efficient. It should take no more than a few minutes to complete your account creation.

Is it safe and secure?

Revolut works with partner banks to keep your money safe. The funds are held by Metropolitan Commercial Bank, a member of the FDIC, and insured by the Federal Deposit Insurance Corporation for up to $250,000.

In addition to FDIC insurance, the company offers award-winning security systems to keep your money safe. You can use your card freely without having to worry about your data.

How do I contact Revolut?

The best way to get in touch with Revolut is to get in touch via in-app chat. Revolut customer service is available 24/7 to answer questions via chat.

If you decide to open an account with Revolut, you can expect a smooth customer experience. The company has earned 4.4 out of 5 stars on Trustpilot with over 100,000 customer reviews.

You can follow Revolut on Facebook, Instagram and Twitter @revolutapp_us to stay up to date on the latest products, features and promotions.

Is it worth it?

Revolut offers a plethora of features that could come in handy for anyone traveling internationally or sending money, however rare. The ability to easily exchange money without outrageous fees is well worth it.

Furthermore, Revolut’s financial features are top notch. In one place, you’ll find tools to help you build savings and manage your budget. In addition, you can invest in Crypto directly in the app.

All in all, Revolut presents a great opportunity for people looking to streamline their finances.

Get started with Revolut here >>

Revolut Features

Default: $0

Premium: $9.99

Metal: $16.99

Default: 0.05%

Premium: 0.07%

Metal: 0.07

Yes, offered at select retailers

Supported Fiat Currencies

Supported cryptocurrencies

$0 to $200,000 per month

None (online business only)

Free up to $1,200 per month (then 2% fee)

24/7 (Premium & Metal plan users get priority)

Web/Desktop Account Access

34699 (via Metropolitan Commercial Bank)

Please note that Revolut regularly updates its products and features. Please refer to Revolut’s Terms and Conditions for the latest offers.

This post One app to spend, transfer, save and invest

was original published at “https://thecollegeinvestor.com/39371/revolut-review/”