At this point in our retirement series, you should have a solid understanding of how to save for retirement. So far we’ve gone over how much you should save from your paycheck for retirement, the different investment accounts, like 401k or 403b, and more. If you haven’t figured out how much you need to save yet, you can use the resources in the previous chapters to help you figure it out.

With all that knowledge, you might now be wondering: How can I retire early?

In between meetings with coworkers, busy periods full of impending deadlines, and a seemingly never-ending list of tasks, some American workers might daydream about the possibility of leaving it all behind for early retirement. While this option isn’t feasible for all workers, retiring early can open a world of possibilities. Early retirees can get a head start on their travel bucket list or even switch career paths. Or, some may just want to spend more time with family.

With that said, retiring early isn’t the right choice for everyone. Early retirement requires budgeting early on in life, aggressive savings, and a firm plan for the future–with the flexibility to absorb the unexpected built in.

If you’re interested in learning how to retire early, it’s important to get a comprehensive understanding of what it involves. Keep reading for a full explanation or jump to a section that answers your question directly.

Why Do Some People Retire Early?

Some of the biggest proponents of early retirement are followers of the FIRE Movement. FIRE stands for Financial Independence, Retire Early, and it’s based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65. Up to 70% of all income during their working years goes into savings. When FIRE followers leave the workforce, they plan to live off small withdrawals from their portfolio until they hit the age of 65.

FIRE does have some serious drawbacks to consider. Saving 70% of your annual income can mean you trade an early retirement for a potentially poorer quality of life during your prime. In addition, if the stock market drops or another unexpected event occurs causing a drop in interest rates, those depending on the FIRE plan may have to turn to “Plan B” to get by.

If the traditional FIRE plan seems too extreme, there are more measured approaches to saving for retirement you may want to consider as well. Most of these plans involve putting above-average contributions into retirement accounts, like a 401k account, adapting a more minimalist lifestyle, and potentially doing part-time work with early retirement.

Benefits of Retiring Early

Retiring early offers a range of benefits that can increase your quality of life and allow:

More time with loved ones: One of the biggest reasons why people are attracted to retiring early is that it allows people to spend more time with family and friends.

Ability to travel: The earlier you retire, the less likely you’ll be dealing with age-related health issues – which may impact your dreams of world travel.

Better health: If stress and other health issues related to your job plague your body and mind, retiring early could help restore your health. Retirement means you can sleep later, prioritize exercise, eat three square meals a day, and incorporate other healthy habits that might have fallen by the wayside during your years in a work environment.

Make a different career move: Retiring early also gives you the opportunity to start a new career. Perhaps you want to switch fields, start a new business, or pursue your idea of monetizing a hobby.

Should I Consider Retiring Early?

For many, retiring early is a possibility, but typically that’s only if you plan early and take a conservative approach. It’s also important to avoid painting an overly rosy view of retiring early; it can be a difficult dream to manifest.

One common way Americans retire early is if their company gives out early retirement offers. COVID-19, in particular, has caused many companies to deliver retirement offers to senior employees in an effort to save money.

But before you decide that retiring early is the right choice, it’s critical to consider the disadvantages as well.

Disadvantages of Retiring Early

Health impacts: Just as retiring could help boost your health, it could also lead to mental declines. Leaving the workforce suddenly can be a difficult lifestyle transition and impact you in ways you weren’t anticipating. In fact, the National Bureau of Economic Research reported that retirement can lead to poor health outcomes. However, that same report also found that retirees who kept up their social activity and exercise were less likely to experience these issues.

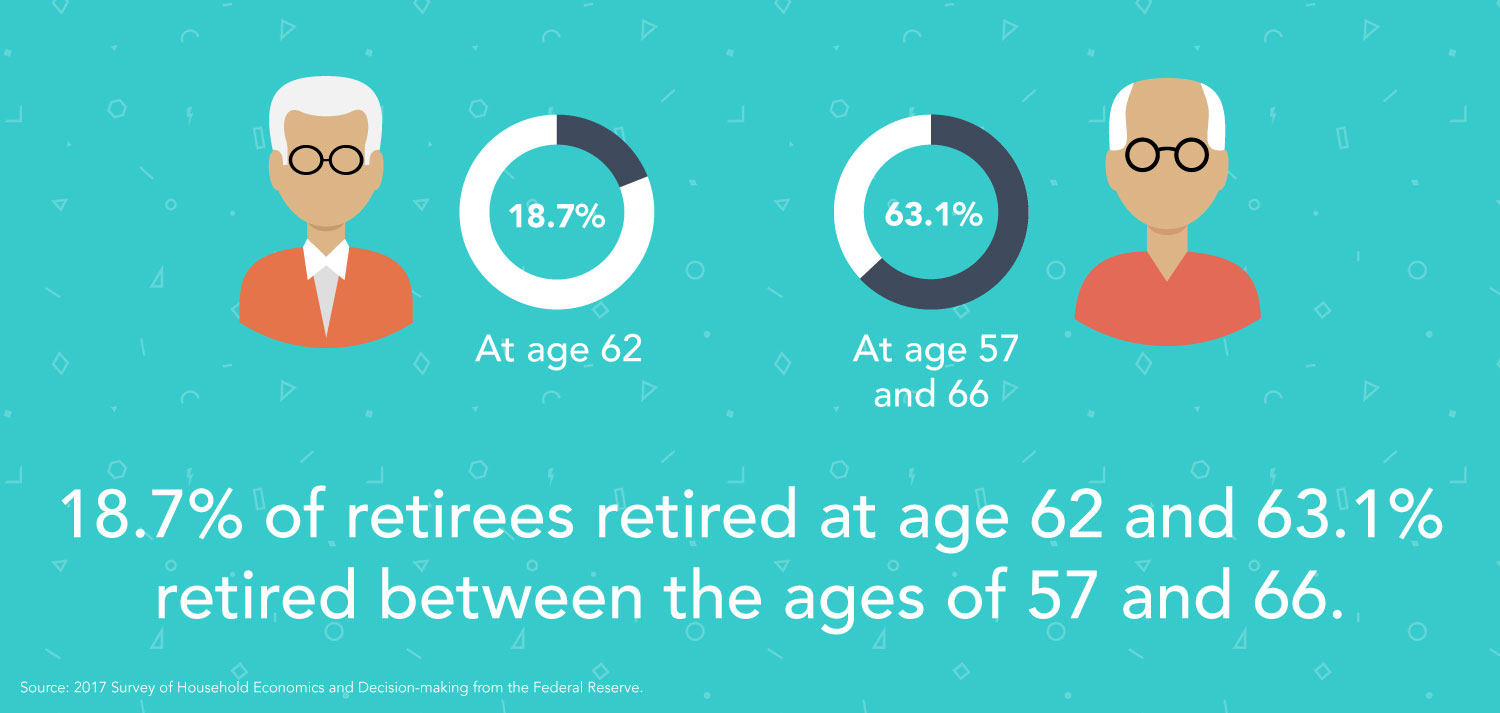

Decreased or smaller Social Security benefits: The earlier you start using your Social Security benefits, the less time your benefits have time to grow. In fact, if you start taking your SS benefits at the earliest age of 62, your monthly payments will be significantly less than if you had waited until your “full retirement age”.

Savings stretch: Retiring early sounds great in theory, but if you retire at age 60 and live until 100, your savings would need to last at least 40 years. When you work longer, you have more time to maximize your 401k contributions and allow your money to grow due to compound interest.

No health insurance coverage: You’ll need to find health insurance on your own until you can get Medicare at age 65. It’s important to note that buying individual health coverage as an older adult is typically very expensive.

Can impact other savings goals: If you have kids, you might be saving for retirement and college. Or, perhaps you’re also saving for a home. Aggressively saving for retirement might not be realistic when other savings goals are more pressing. In addition to these other savings goals, it’s important to create a financial plan if you want to retire early so you can figure out exactly how much you need to save to accomplish them.

How Can I Retire Early?

So now that you know the pros and cons of retiring early, you’re probably wondering: how do I retire early?

If you decide to retire early after weighing the pros and cons, it’s important to spend adequate time actually planning for it.

Start by reading tips from investors who retire early and other workers who made their retirement happen years earlier than expected. Although anecdotes shouldn’t form the basis of your early retirement preparation, reading the accounts of like-minded individuals can help you anticipate potential problems you may encounter. These stories might also expand your understanding of what it’s really like to retire early–and give you some insight into whether you’re equipped to handle those realities.

Besides gathering knowledge and doing your due diligence, it’s also important to sit down and crunch the numbers to see if becoming a younger retiree is possible. Here are a few steps you should take to build a basic framework for your early retirement:

Calculate your annual retirement spending. To do this, look at your current monthly spending and take into account what expenses might increase or decrease. Add your monthly expenses and multiply that number by 12. Ideally, you’ll increase it by 10% to 20% to work in wiggle room for unexpected expenses or splurges. It’s a good idea to make a retirement budget so that you can have an idea of how much your expenses will cost in comparison to your income.

Estimate your total savings needs. A common rule of thumb is aiming to save 25 times your planned annual spending before you retire. Your exact number may be more or less depending on your lifestyle and other relevant variables. To make sure you’re saving enough each month, it’s important you have an idea of your personal savings rate.

Invest. It’s also important to start investing in a retirement portfolio set up for long-term growth. You may want to prioritize contributing enough to your retirement accounts in the context of your retirement horizon. Retiring early means you have less time to let your retirement investments grow. There are a variety of investment accounts you can have, like an IRA vs. 401k, so make sure you take advantage of whichever is best suited to you.

Focus on paying down debt. If you focus on getting out of debt, you can focus on saving. Money that isn’t going to pay your debts could be growing in a retirement account. And even if you have debts to pay, withdrawing from your 401k or IRA early may not be the best solution. Early Roth IRA withdrawal and early 401k withdrawal can cause a variety of penalties and hinder your investment growth. If you’re seriously contemplating cashing out your 401k to pay off debts, it’s important to weigh the pros and cons so you can determine if it’s the right choice for you.

Stick to your budget. And finally, it’s important to stay on track with your budget so you can actually achieve your retirement goal. Consider evaluating your savings and investments each month to make sure you’re on the right path.

With our retirement savings calculator, you can see whether you’re on track to retire early.

Considerations to Factor into Planning to Retire Early

Besides doing the math to help you reach your retirement goals, it’s also important to know exactly what kind of retirement you want.

Here are some questions to ask yourself when planning for retirement:

Are you planning on retiring in your hometown?

Are you aiming to move to a tropical destination?

Do you want to relocate somewhere with a cheaper cost of living?

You’ll need to factor those kinds of living costs and lifestyle choices into your overarching plan. If your goal is to retire early, it might be a good idea to check out more affordable places to retire so that you can spend less on living expenses, like rent and food.

In addition to the above questions, you should also ask yourself certain questions like:

Are you putting away enough of your paycheck each month to build your retirement savings?

Will you have additional income like a pension?

Do your spending habits reflect your goals?

If you’re planning on early retirement, you’ll also need to think about other expenses that go above and beyond a general monthly budget, such as:

Long-term healthcare

Travel plans

Gifts for grandchildren

Whether you plan to own a home

Emergency expenses

Are You on Track to Retire Early?

Planning for retirement is key for future financial success, especially if you want to retire early. It’s important to monitor your savings progress so you can ensure you’re on track with your goals.

You can track your progress in a couple of ways. You can use our retirement calculator, which shows you how much you need to retire and what your retirement savings progress is. You can also use the Mint app to track your savings and make sure you’re sticking within your budget.

You can benefit from regularly evaluating the status of your retirement accounts so you can know if you should improve your 401k balance or diversify your portfolio in order to maximize your investments. It’s also important to revisit your budget to see if it still reflects your goals and make any adjustments if necessary.

If you’re not already, you may want to consider using a financial advisor who can assist with planning. You can never get too much help when it comes to planning for retirement.

Key Takeaways: How Do I Retire Early?

Some of the biggest proponents of early retirement are followers of the FIRE Movement, which is based on a financial plan defined by an intense savings program that allows for individuals to retire much earlier than 65.

Benefits of early retirement include:

More time with loved ones

Ability to travel

Better health

You can make a different career move

Disadvantages of early retirement include:

Health impacts

Decrease Social Security benefits

Savings stretch

No health insurance

Can impact other savings goals

If you decide to retire early after weighing the pros and cons, it’s important to spend adequate time actually planning for it.

With our retirement savings calculator, you can estimate whether you’re on track to retire early.

It’s important to monitor your savings progress so you can ensure you’re on track with your goals.

Early Retirement and Planning for the Future

Early retirement isn’t right for everyone. At the end of the day, retiring early can involve more risk than traditional retirement. You might have to tap into your Social Security and, in turn, lower your monthly payment potential. A downturn in the market can mean your portfolio returns aren’t as high as you expected.

If you do decide to plan for early retirement, it’s important to build in flexibility and consider a middle-road approach. Perhaps you can consider keeping a side job to tide you over until you qualify for Medicare, for example. With these tips, you can plan a happy, successful retirement with peace-of-mind.

This is the last chapter of our retirement series, and we’ve now covered pretty much everything there is to know about retirement. You should now have a much better understanding of how to prepare for retirement so that you can live as comfortably as possible in your golden years. If at any point you need a refresher, you can go back and reread any of the chapters in the series so you can stay on top of your retirement goals. To easily track your progress, add your retirement account to Mint now.

Source: National Bureau of Economic Research | Social Security Administration | Unassuming Economist

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

Learn more about security

This post How to Retire Early | Chapter 11: Retire Early was original published at “https://mint.intuit.com/blog/retirement/how-to-retire-early/”