If you have federal student loans, that monthly payment can easily feel like a burden. The CARES Act gave people with federal student loans a welcome break from paying during the turbulent economic impact of the pandemic.

However, another benefit that many didn’t realize is that if you’ve paid your student loans in the past 24 months, you can ask for a refund of your payments.

Let’s take a closer look at what you need to know about getting your federal student loans back — and whether you should consider it.

CARES Act and Student Loan Payments

If you are a borrower with federal student loans, the CARES Act stepped in to pause your federal student loans when the pandemic disrupted the economy. The new legislation has not only paused your payment terms, but also set the interest on your loan at 0%.

The benefits are effective March 13, 2020. After multiple renewals, these benefits are currently available until August 31, 2022. Note that they can be extended even further.

If you decided to continue paying your federal student loans after March 13, 2020, that would effectively help you get out of debt faster. But there was no obligation to track your payments during this system-wide hiatus.

Which student loans are eligible for repayment?

The past two years have been a roller coaster ride. Due to the rapidly changing economy, your income may have increased, shrunk, or both in recent months. With that, you may want to get a refund of those extra student loan payments because of a change in your financial situation.

If you have paid student debt during the suspension period, you are eligible for a refund from the Ministry of Education. Specifically, the loan must meet the following requirements:

Federal student loans only. Private student loans are not eligible for a refund. Payment window. You can only get a refund on student loans paid between March 13, 2020 and August 31, 2022.

If you have paid student finance before the start date of March 13, 2020, those payments are not eligible for a refund.

How to get a refund on your federal student loans?

To get a refund on your federal student loans, here’s what you need to do.

Collect payment information

The first step is to find out which payments you want refunded.

Look for the payment amount and the date of your payment. If you made the payment between March 13, 2020 and August 31, 2022, it is eligible for a refund.

Most service providers require proof of payment. So get a copy of your online student loan payment history, your bank statements with the transaction, or a payment confirmation email.

Talk to your lender

Once you have the details of the payments you wish to repay, it is time to contact your loan manager. Let them know you want a refund for eligible payments.

Depending on your service provider, you may be able to contact them by phone. That may be the best option because this is a relatively unique request.

But an email/secure message will also work. Here’s a template to use when submitting your request:

For whom it concerns:

I am eligible for a student loan refund due to the CARES law. I want my payments made from date X to date X to be refunded. Let me know if you need additional information. Thank you!

After you hear from the servicer, they should let you know how the payment will be processed. Usually, the administrator returns the refund via the original payment method. So if you made a payment through your checking account, the money should be deposited there.

Should you ask for a refund?

Repayment of your student loan is not always the best option. After all, if you get money back now, you will eventually have to pay that money back later.

Let’s see when it makes sense to pursue a student loan repayment.

Financial problems

A lot can happen in two years.

Your financial picture may have been stable in March 2020. At that point, it might have made sense to pay off your student loans toward your financial goals during the break.

But if life has presented you with challenges, your financial picture may now look dramatically different. For example, a job loss or an increase in your daily expenses can make it difficult to make ends meet.

If you’re experiencing financial difficulties, those student loan payments can really come in handy now. With that, pursuing a refund would be the right move.

You seek forgiveness for loans

If you are looking for a student loan forgiveness option, a refund of your student loan payments is the most financially efficient option. That’s because the months of forbearance allowed by the CARES Act will continue to count toward eligibility for forgiveness. As such, by making payments on your loans, you are giving the government extra money that would likely be forgiven!

“Never give the government extra money!”

For example, if you seek forgiveness through the Public Loan Forgiveness Program, each month of public service employment from March 13, 2020 to August 31, 2022 will automatically count towards PSLF – one payment will make no difference. So there is no reason to pay more than necessary.

Other opportunities

This option carries more risk, but can you use the money for another opportunity, such as buying a house or investing?

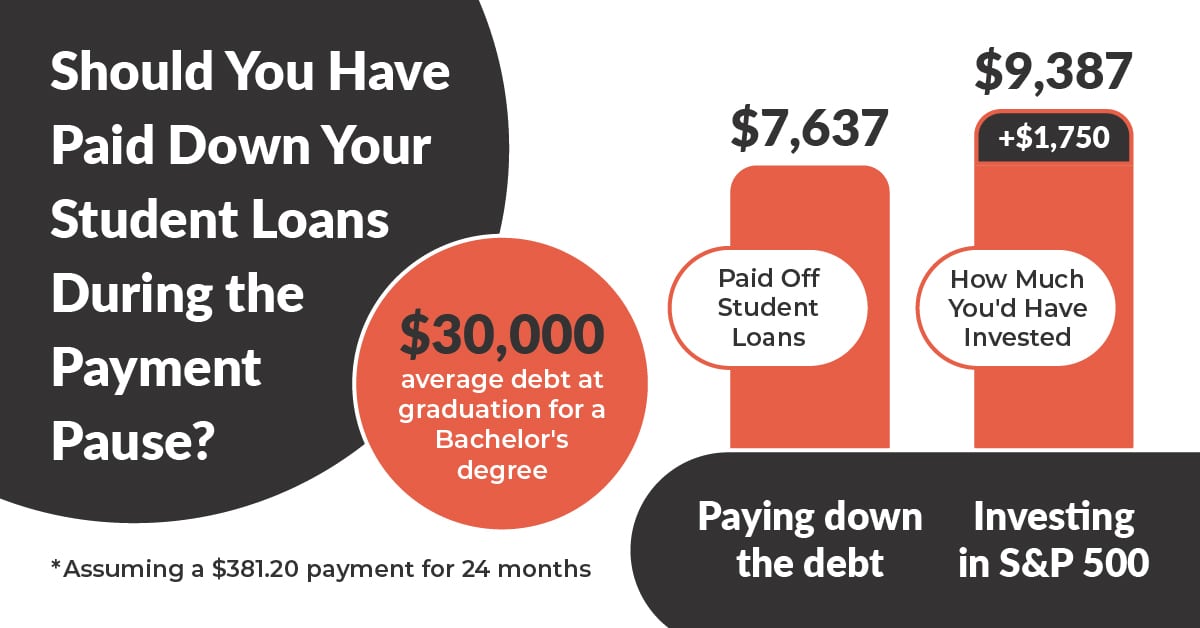

We recently looked at the numbers on whether you should have paid off your student loans or invested during the pandemic — and the average student loan borrower would have been $1,750 richer if they had invested their loan payment dollars instead of giving them to the government. to give.

However, you can’t change the past – so making the switch to investing today may be a different story. The stock market is in a very different place, and we’re probably much closer to the end of the payback pause (although some argue it’s possible to extend the payback pause forever).

Final Thoughts

If you paid federal student loans from March 13, 2020 to August 31, 2022, the CARES Act states that you are entitled to a refund if you wish.

The refund is a valuable opportunity for those who need the money now or want to take advantage of a forgiveness option. But if your finances are in good shape and you are not pursuing forgiveness, you may want to put off this cash influx and enjoy the fact that your loans are paying off a little.

This post How to get a refund on your federal student loans?

was original published at “https://thecollegeinvestor.com/39678/refund-federal-student-loan-payments/”