Your credit score indicates your creditworthiness. It’s a number that tells creditors your level of risk. Many businesses, including insurance companies, phone companies, credit cards, and loan and mortgage providers, review your credit score when determining if they should issue you a policy, loan, or service—along with the rates and terms you’re eligible for.

The higher your number, the less risky you are, meaning you have a better chance of receiving approval. Your credit score is one of the three key factors that determine your overall financial health. That’s why it’s important that you always have a general idea of what your credit score is. But how do you check your credit score?

Checking your credit score isn’t as challenging as it may seem, and once you know how, the process becomes faster and easier each time. Several methods are available for checking your credit. Review the options below to determine which one makes the most sense for you.

In this chapter, we’ll be going over how to check your credit score, why checking your credit score is important, and more. Continue reading or use the links below to learn how to check your credit score for free.

In the previous chapters in our credit series, we went over what a credit score is, the importance of credit scores, factors that impact your credit score, and more. You should now have a much better understanding of what a good credit score is and how to increase your credit score if needed. If you need a refresher, go back and read these chapters first.

Step 1: Check Your Credit Card or Loan Statement

When you apply for a credit card or loan, the lender pulls your credit information to determine if they’ll approve you. These entities will provide you with your credit score or you can ask them to send you a copy.

Receiving your credit score from an entity you’re already working with can save you time and money. But if you’re not planning to apply for a credit card, loan, or other new line of credit in the near future, it may be best to choose a different method for checking your credit score.

Step 2: Use a Free Service

A range of services are available that allow you to check your credit score for free. No matter which service you choose to use, follow the steps listed on the website to receive your free credit score. Be sure to read the fine print before entering your credit card or payment information.

You can also get a free credit report once a year, which is a more detailed overview of your credit history.

Step 3: Purchase Your Scores

In addition to the free services, you can also receive your scores through one of the three major credit bureaus (Experian, Equifax or TransUnion) or an outside entity. According to the Consumer Financial Protection Bureau, credit reporting companies cannot charge more than $13.50 per credit check.

Some people choose this option because they like what a particular report offers or because a free method isn’t currently available to them. Many free services offer a variety of valuable information, so do your research before determining which option is best for you!

What to Know When You Check Your Credit Score

While a credit score may seem straightforward, there are some nuances to be aware of. By understanding key information about what your number means, you’ll get the most out of your credit score check.

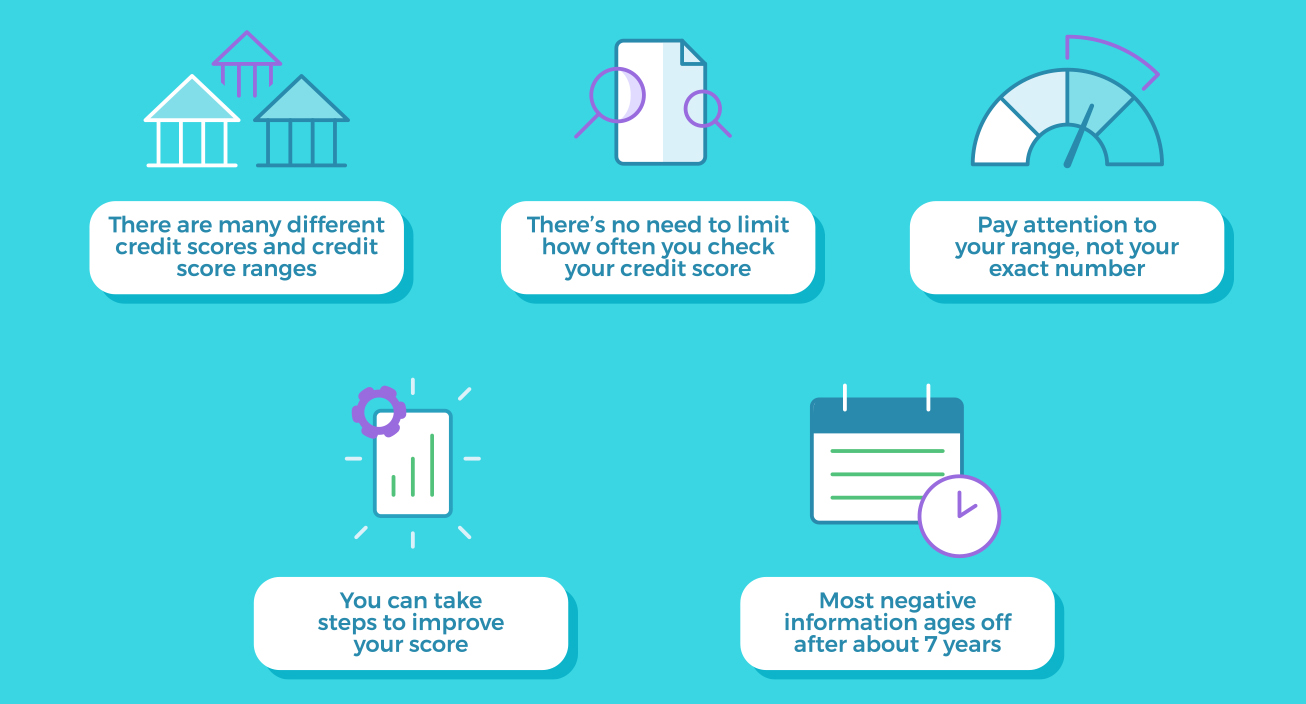

There Are Many Different Credit Scores and Credit Score Ranges

You can have multiple credit scores because not all credit bureaus and credit reporting entities utilize the same scoring system. For example, there are several websites and apps like Turbo that provide a free score and tools like a free personal loan calculator. The scoring model used may be slightly different than another bank, lender or credit bureau. If you were to check your credit score through a couple of different entities, you’re likely to receive somewhat differing numbers.

In addition, each entity may categorize their credit score ranges differently. One organization might define good credit as anything above 700, while another entity might say that anything above 680 is good. Keep this in mind as you review your score and compare it with the guidelines of the financial product or service you’re considering.

There’s No Need to Limit How Often You Check Your Credit Score

Checking your own credit is considered a soft inquiry, not a hard inquiry. Soft inquiries don’t impact your credit score, so checking your score often won’t cause it to lower.

You’ll also want to review your credit report periodically, which lists your:

Payment history

Open lines of credit

Any outstanding debt

By reviewing your report, you’ll be able to identify cases of fraud or outstanding credit you’ve forgotten about.

A credit report is a type of credit reference, which is required when you’re looking to borrow money from a service or lender. So if you’re planning on buying a house and will need a loan to do so, take a look at your credit report to make sure you’re in good standing.

Pay Attention to Your Range, Not Your Exact Number

Your credit score can fluctuate and can even differ based on which entity calculates your score. That’s why it’s more important to focus on the range your score falls in, rather than your exact number. Typically, credit scores range from 300-850. Generally speaking, between 740-799 is considered a “very good” score and an “excellent” score is 800 and beyond.

You can learn more about credit score ranges in Chapter 4.

You Can Take Steps to Improve Your Score

The credit score you start with will change as soon as you start to build credit. But if your credit score is not where you’d like it to be, there are plenty of methods for raising it. Although any method to improve your credit score will take time, a higher score increases your eligibility for financial products, loans, and credit card offers.

Clean up your credit report: Review your credit report and identify whether you need to change your financial behavior in any way. While you can’t remove negative items from your report, they typically will age off after seven years. Make sure to also look for false items on your credit history, such as an unpaid bill.

Be timely with your payments: Whether it’s a utility bill or credit card payment, be sure to consistently pay on time. Make sure you pay off your loans on time as well.

Pay off your debt: While you do need to have some debt to show that you can pay it off responsibly, you don’t want to rack up large credit card balances or lease a new car every year. In other words, your balance shouldn’t become a high percentage of your overall credit line.

To accomplish this, continue to pay off your outstanding debt and avoid unnecessarily large purchases. You want to aim to have a low debt to credit ratio as this indicates you’re able to make purchases on credit responsibly.

Limit how many new lines of credit you open: A lender may consider how many new lines of credit you’ve recently applied for, which could negatively impact your score.

Maintain long-term accounts: A solid track record of paying off your credit on-time will show a potential lender that you are reliable. Try to keep a couple of accounts open, active, and paid over time to demonstrate a strong credit history.

While you might be tempted to remove a closed account from your credit report, it’s not always the best idea as it could lower your credit score. But if the account has negative information, it could help your score. It really differs for each person’s financial situation, but just make sure to do some research before removing a closed account from your report.

Most Negative Information Ages Off After About 7 Years

While a late payment or unpaid bill stays on your report for a while, credit reporting doesn’t occur for longer than seven years from when the original debt was charged off. Exceptions to this rule include defaulted student loans and bankruptcy.

It’s Important to Check Your Credit Score

So we’ve gone over how to find your credit score, but why is it important to check your credit score?

Understanding and monitoring your credit score allows you to be in tune with your financial standing and make adjustments as needed. Checking your credit score periodically offers a few important benefits. Get your absolutely free credit score with Mint–it’s quick and easy!

There are many side effects of a bad credit score, like higher interest rates and higher insurance premiums, but as long as you implement good credit building habits, you can raise your credit score in as little as six months. Checking your credit score often will help keep you on top of your finances so you can quickly figure out how to increase your score if it drops.

Understand Your Financial Standing

Your credit score is one indicator of your overall financial health. It provides information about your credit experiences and your history of paying bills, in addition to any outstanding debt you may have. By checking your credit score, you get a glimpse where you currently stand financially.

Your credit score can almost always be improved (unless you’re one of the lucky few with perfect credit), so knowing your score gives you key insight into whether or not you should prioritize giving your score a boost.

Several companies consider your credit score along with your other financial indicators, like your income and debt-to-income ratio, when approving you for a loan or service. Your credit score provides an indication of how likely you are to repay the loan amount on time.

Ensure You Can Get the Best Terms

When lenders pull your credit score and credit report, they receive your history of paying bills, how long you’ve had certain accounts, and if debt collection has ever been utilized. Based primarily on these factors, they will then make a determination of the terms they will offer you. Typically, the better your credit score, the lower fees or rates you’ll receive.

If your score isn’t where you’d like it to be, you can take time to work on your score before following through with a lender. You might improve your credit score by doing things like paying off your current debt and being timely with all of your payments.

Determine Eligibility for Financial Products

Some lenders and financial vendors provide guidelines as to what they’re looking for from a potential borrower. For example, a credit card company might require a score of 720 or above to be approved, or a mortgage company may require a credit score within a particular range to lock in a certain interest rate. By knowing your score, you’ll have a better understanding of which financial products and terms you might be eligible for.

Alert Yourself of Potential Fraudulent Activity

Pulling your credit score won’t give you direct information regarding fraudulent activity, but it could be a clue that fraudulent activity has occurred. If you think your credit score is suspicious, be sure to pull your credit report or sign up for credit monitoring.

Key Takeaways: How to Check Your Credit Score

Several methods are available for checking your credit:

Check your credit card

Use a free service

Purchase your scores

See a nonprofit credit counselor

You can have multiple credit scores because not all credit bureaus and credit reporting entities utilize the same scoring system.

It’s more important to focus on the range your score falls in, rather than your exact number.

There are plenty of methods for raising your credit score.

Understanding and monitoring your credit score allows you to be in tune with your financial health and make adjustments as needed.

Empower Yourself with Credit Knowledge

Knowing how to check your credit score gives you instant access to your financial standing and helps you better understand what improvements you might like to make to your private life. Regularly checking your credit score and identifying areas for improvement is key to maintaining a strong financial life. To get started, get your free credit score in the Mint app and spend some time assessing your financial goals.

So we’ve discussed how to get your credit score and why checking your credit score is important, but what do you do when there’s a mistake with your credit? In the next and final chapter, we’ll take you through the steps of what to do if you find an error in your credit report.

Sources: Consumer Financial Protection Bureau | Federal Trade Commission 1, 2, 3, 4

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

Learn more about security

This post How to Check Your Credit Score | Ch.9 Credit Monitoring was original published at “https://mint.intuit.com/blog/credit-score/how-to-check-credit-score/”