The 529 College Savings Plan is one of the best ways to save for college. But most people don’t take full advantage of it. And I’m not going to lie – I’m one of them.

The idea of a 529 College Savings Plan is great: you can deposit money into an account and it will become tax-free to pay for your child’s education one day. And you can contribute a lot of money too (up to $300,000 in most states). That’s not where the problem arises.

The real problem comes from rising tuition costs and how much every “college savings calculator” tells you to save for your child’s education. According to The College Board, the average cost of a public 4-year college in 2020-2021 was $10,740 in state tuition. The median cost for a private school was $38,070.

When you start entering those numbers into the college savings calculator, you suddenly have to start saving over $500 a month for your child. Then add that to your own savings for retirement, and you won’t be left with something for yourself every month!

So let’s dive in and see how much you should have in a 529 plan.

If you’re looking for an easy way to save for college, check out Upromise. This is a free service designed to help families pay for college simply by doing their regular grocery shopping. Upromise offers cash-back rewards for linking a credit or debit card and using that card at participating merchants. Get started here >>

Follow the order of save for college operations

That one amount gives me a sticker shock every month when I think about saving for my child’s college. But it’s also an important reminder of why everyone should take the Order of Operations For Saving For Your Kid’s College.

The key phrase is YES:

(Y) YOU: You should make sure your own financial house is in order before trying to save for your child’s college. If you can’t pay rent or run errands, there are bigger problems that need to be solved first. However, the YOU bucket also includes saving for your own pension and providing an emergency fund. I’ve said this hundreds of times – you can’t get a loan for your retirement. Make sure to save for yourself first.

(E) Education Savings Accounts: If you’ve been saving for yourself, you can then save for your child in Education Savings Accounts, such as the 529 Plan.

(S) Savings: After contributing to the 529 plan or other education savings account, it’s smart to save into a traditional savings account as well, just in case there are other expenses you want to help your child with that don’t qualify come as education expenses.

How Much Do You Really Need to Save in a 529 Plan?

Part 2 of that “scary” number you need to save each month for your child’s college is that that number is based on saving 100% of their college costs. As a parent, you don’t have to pay 100% of their school. Or maybe you pay 100% of their public tuition, and the rest is up to them. Or maybe you just have a savings target, and the rest is up to them.

It’s just important to remember that you don’t have to save and pay for all of their colleges. It’s THEIR university – not yours. Plus, there are countless ways they can find help paying for school, from finding scholarships to getting student loans.

Here’s our guide to how to pay for college.

So instead of worrying about saving $500 a month, I’m going to make the following assumptions and save based on that:

I’m going to save for an in-state college that currently costs $10,200 a year I’ll contribute to all 4 years of college I’ll pay 50% of the expected college costs I’ll finish contributing to the 529 plan when my child is 18 (sorry , but you’re out of the house now!) I expect tuition fees to continue to rise at 4% per year I expect to get a 6% per year return on my investments in my 529 plan

With these assumptions, you should save about $96 per month for your child’s college, or $1,151 per year. Let’s see how that breaks down.

However, if you’re on the high side and want to contribute to pay 100% of your child’s education costs to a 4-year private school, I’ve included that in the table below as well (for reference, that means you’re contributing $630 per month ).

If you want better estimates, check out our 529 Plan guide by state, look up your state, and see what the cost of attending college is in your specific state.

How Much Should You Have in Your 529 at Different Ages?

Fidelity also has a great free calculator that will help you determine how much you need specifically for your situation. They use many of the same assumptions we make above, agreeing that you don’t need to save 100% of your child’s college costs. Check out the calculator for heirs of tuition here.

You may also find this 529 plan contribution limit guide helpful.

529 College Guidelines for Savings Plans

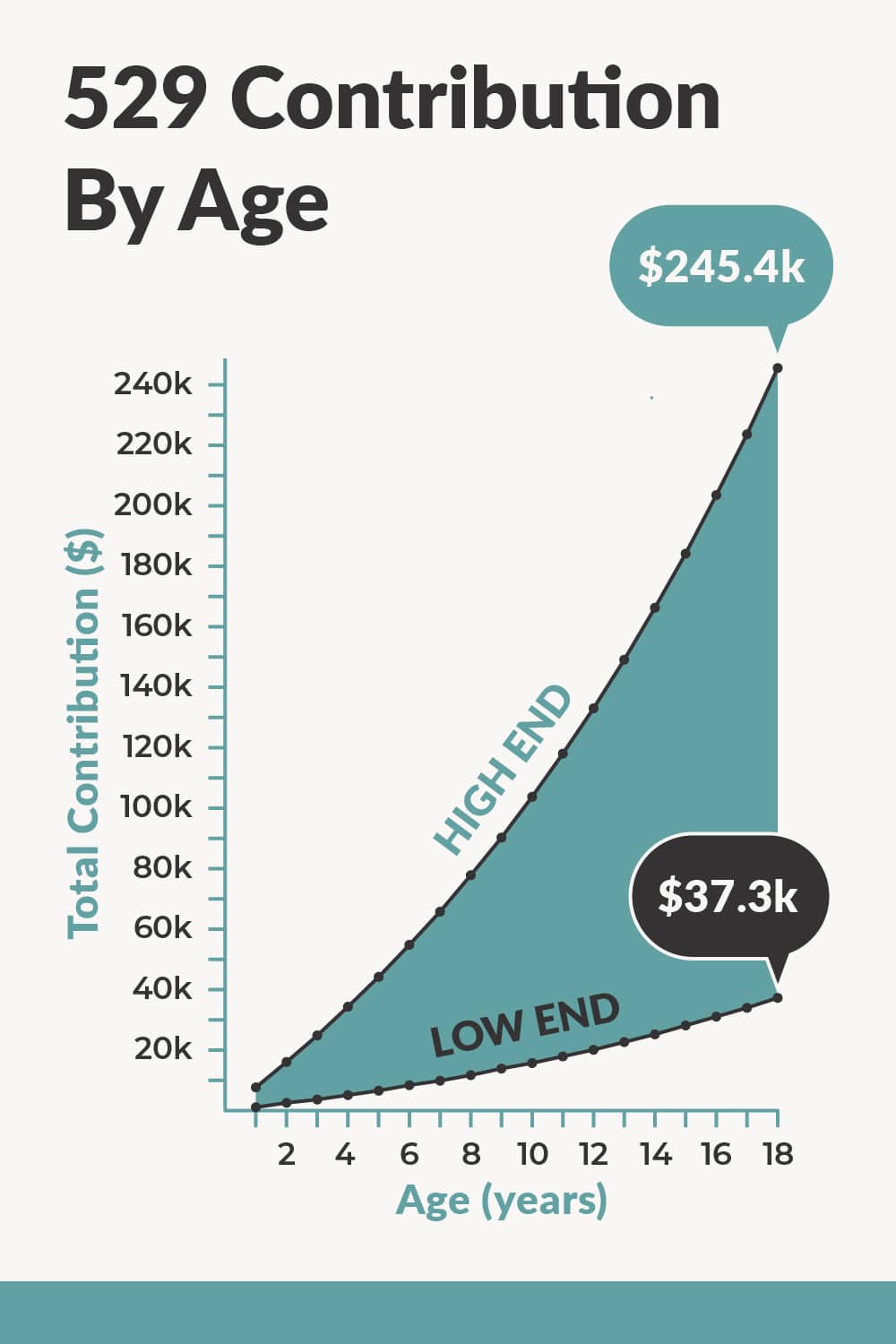

From the results, we can conclude that the goal for most people saving for college should be to have between $37,328 and $245,427 in the account. This is undoubtedly a huge reach. But remember what “low-end” and “high-end” mean.

The low amount is for someone who wants to help their child pay for a 4-year public school. The high amount is for someone who wants to fully pay for a 4-year private education for their child.

Parents should also remember that even if they are saving for private school, many students who attend private school receive tuition discounts or scholarships to offset the “real” tuition price. So even that high-end number might not make sense when saving for college.

In this scenario, the low-end 529 plan can pay out between $9,600 and $10,000 per year for each of the 4 school years. Given that college costs will rise, that should be about 50% of a 4-year public school in 18 years.

Where to open a 529 subscription?

What many people don’t realize is that you can invest in almost any state 529 plan. For some people, it may make sense to use your home state’s plan to take advantage of the tax deductions — but not all states offer tax deductions on contributions (especially California).

If state doesn’t matter, the next things to look at are performance and ease of saving. For performance, you want good performance at a low cost. For the convenience of saving, we look at whether the plan can be linked to savings programs such as Backer.

Check out this guide here, find your state, and see which plan we recommend: 529 Plan Guide.

SavingForCollege.com ranks the best plans every year. Which subscription you choose depends on the state you are in. Check out the map below and find your state:

Recommendations to help save for college

Even saving just $100 a month can seem like a daunting task. I know it’s for me. However, when it comes to saving for college, here are some simple tricks that can help:

1. Save all your child’s birthday and holiday money. In many families, children receive money from their grandparents, aunts, uncles, and more. I estimate that the average child receives at least $200 a year in gift money. If you saved that, you’re 20% of the way to fulfilling their 529 annual contribution.

A great way to do this is to use a service like Backer. Backer makes gifting a 529 subscription so easy – so you can both save for your kids and help a friend or family member save.

2. Look at Upromise. This is a free service designed to help families pay for college simply by doing their regular grocery shopping. Upromise offers cash-back rewards for linking a credit or debit card and using that card at participating merchants. You can earn anywhere from 1% to 25% back at various retailers. Upromise says some members make at least $1,000 a year — that’s almost all you need to fully fund a 529 subscription. Plus, you can now get a $25 bonus if you link your 529 plan within 30 days of signing up! UPromise is easy to sign up and save for college – check it out here.

3. Focus on making more money. Instead of looking at where to cut in your budget, ask yourself: How can you add $100 in revenue to your budget? I firmly believe that anyone can make an extra $100 per month, and what better way to use that extra $100 than by funding a 529 plan for your child? If you’re not sure where to start, check out our list of over 50 ways to make extra money.

This post How Much Should You Have in a 529 Plan by Age?

was original published at “https://thecollegeinvestor.com/16964/how-much-you-should-have-in-a-529-plan-by-age/”