The child tax credit is a tax benefit that can reduce the financial burden on American families with young children. While the child tax credit has been in place in previous years, the amount eligible taxpayers could receive as a result of this benefit reached an all-time high in 2021.

The American Rescue Plan Act of 2021 is an economic stimulus bill designed to help Americans weather the economic turmoil caused by the COVID-19 pandemic. This piece of legislation increased the child tax credit so that taxpayers receive $3,600 for each eligible dependent child under six years of age and $3,000 for each eligible dependent child over six years of age.

For an in-depth answer to “how much is the child discount for 2021?” and more explanations about who is eligible, read this article from start to finish. You can also jump to a section in the article from the links below.

Tax Rebate for Children 2021

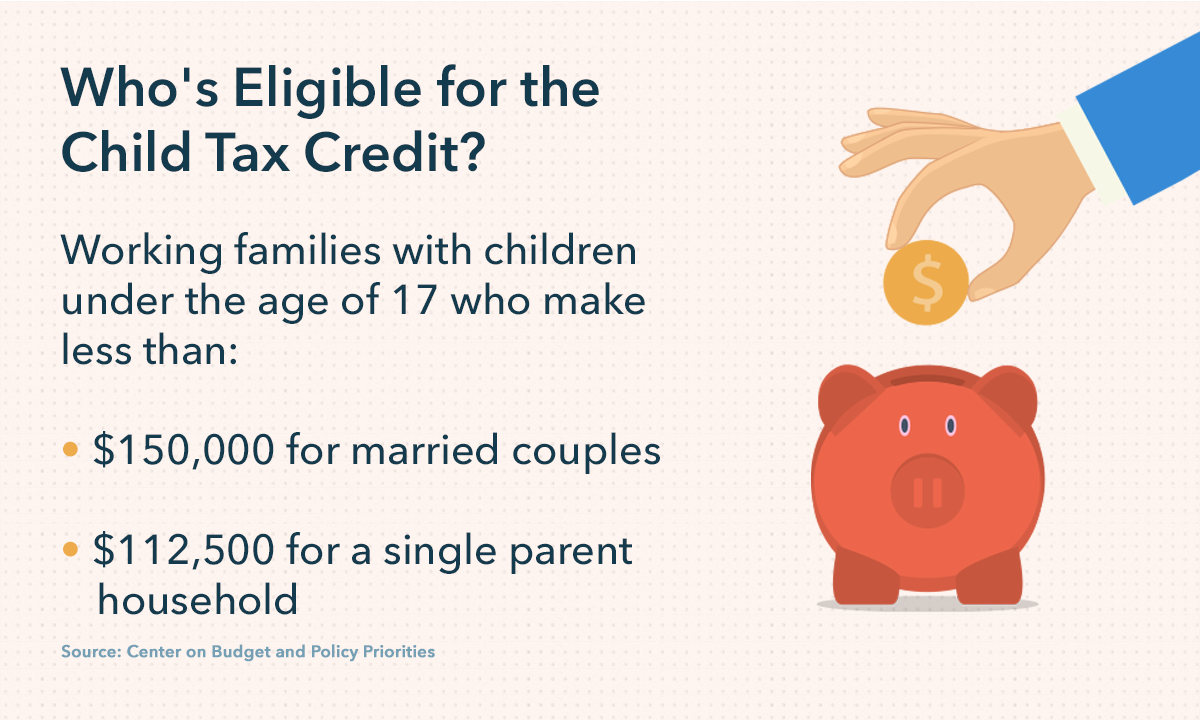

The child discount has increased in 2021 to $3,000 for children over the age of six and $3,600 for children under the age of six (under 17). The 2021 child tax credit will be available to nearly all working families with incomes less than $150,000 for couples or $112,500 for a single-parent family.

What is the tax credit for children?

The child tax credit is a benefit that reduces your financial burden on Americans who have eligible dependent children. The child discount is intended to lighten the burden for people with children, so that they can take better care of their families. This benefit is a refundable credit-meaning that if you have no tax liability to settle, you can get the credit amount in cash to cover your other expenses.

The total amount of the childcare allowance depends on: a few factors, such as:

Number of eligible children you have Age of your children Your income

In the following sections, we’ll take a closer look at who qualifies — and who doesn’t — and how much you can expect to receive.

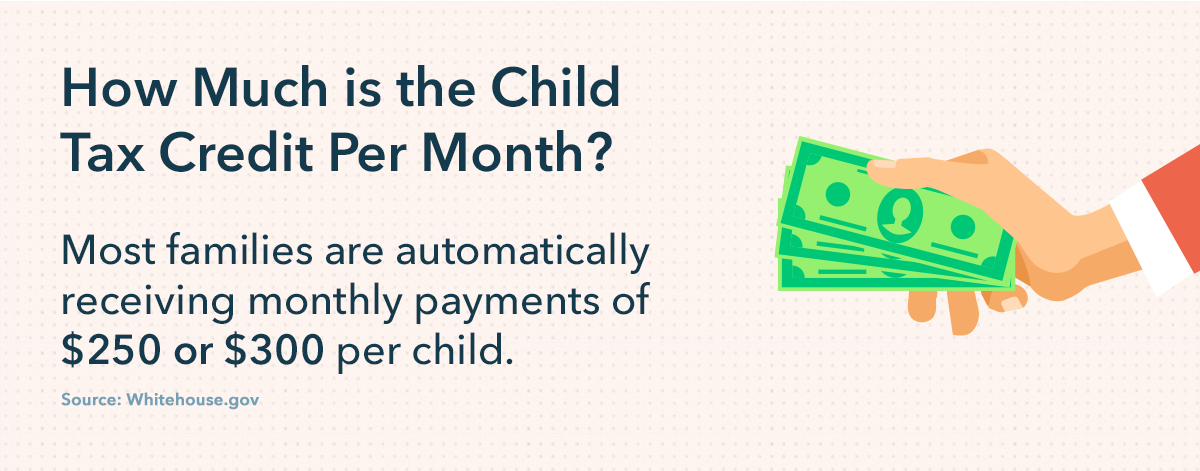

How much is the monthly tax credit for children?

For 2021, the child discount has risen sharply compared to previous years. In 2020, taxpayers could claim a maximum tax benefit of $2,000 for each person under the age of 17.

So, how much is the child discount per month? There is currently no more monthly payment. Congress has not passed any laws extending this payment.

To help taxpayers support their families, the American Rescue Plan has considerably expanded the children’s discount in 2021 so taxpayers can now receive $3,600 for each dependent child under six years of age and $3,000 for each dependent child over six years of age. The extended credit benefits about 9 out of 10 children across the country.

On a monthly basis, the White House reports that as of July 15, 2021, most families automatically received monthly payments of $250 or $300 per child. Taxpayers who were eligible for the child tax credit received monthly payments without having to take any action.

However, as mentioned above, there are no monthly payments. This may change if laws are passed to extend the payment.

How much is the child tax credit for 2021?

If you were wondering “how much is the child discount for 2021?”, it was: $3,600 for each dependent child under age 6 and $3,000 for each dependent child over age six† These figures represent the annual tax benefit for the 2021 tax year—$250 or $300 monthly payments are issued depending on the age of your children.

This all-time high child tax credit is further distributed through monthly payments until 2022 if the necessary laws are passed. The legislation also permanently makes it possible for low- or no-income families for the entire year to claim full credit to combat child poverty in the long term.

How much do you get per child?

The American Rescue Plan increased the tax credit for children so that taxpayers with eligible children under 6 receive a benefit of $3,600, while those with eligible children over 6 receive a benefit of $3,000.

We will run through an example scenario to better understand what the child tax credit looks like in a real situation. Let’s say John and Mary are married and have a 3-year-old son and a 15-year-old daughter. In this scenario, John and Mary file their taxes jointly and their adjusted gross income is less than $150,000 per year.

Due to this situation, John and Mary would be eligible for the full child discount in 2021. So they would receive a $3,600 benefit for their son and a $3,000 benefit for their daughter, for a total of $6,600. John and Mary can either claim the full $6,600 when they file their tax returns, or receive half of the total ($3,300) in monthly installments and then claim the other half when they file their tax returns.

While this may seem like a lot of money, the costs of caring for dependent children can add up quickly. Check out our personal finance tips to learn how to make your money sustainable and improve your financial well-being.

Is everyone entitled to the child discount?

Not everyone can claim the child discount. To be eligible for the child discount, you must meet certain criteria. Your child’s eligibility depends primarily on income, but also on whether or not your child meets the definition of a dependent.

How do you qualify for the child discount?

To qualify for the full child tax credit, your adjusted adjusted gross income must fall within the following guidelines:

Submission Status:

Head of the household

Married filing jointly

Modified Adjusted Gross Income (MAGI):

$112,500 or less

$150,000 or less

In addition to meeting the corresponding income threshold based on tax return status, your child must qualify as a dependent child to be eligible for the child tax credit. To be considered a dependent, the following must be true:†

Your child must be 17 or younger. You have provided at least half of your child’s financial support in the past year. Your child has lived with you for at least half of the past year. Your child does not file a joint declaration.

Exceptions exist for some of these qualifications. Visit IRS.gov to learn more about the child tax credit eligibility criteria.

When do child tax payments come in?

Typically, eligible taxpayers can claim the child tax credit when they file their tax returns. In 2021, however, it will be the first time that the IRS will pay the child discount on a monthly basis.

Eligible taxpayers automatically received $250 or $300 per month, from July 15 to December 15. This means that those who qualified for the full child tax credit received $1,500 or $1,800 and can claim the other half of the benefit when they file their 2021 tax returns.

While the child discount increased in 2021, the can go back to $2,000 in 2022† The law expires unless Congress takes action and passes a bill to increase the benefit again. So going forward, it’s important to keep asking, “How much is the child discount this year?” to make sure you know how much you’re getting.

How Does the Child Tax Credit Affect Your Taxes?

The child tax credit can give you a dollar-for-dollar reduction on your tax liability.

If you were one of the taxpayers who received half of your child discount in monthly payments from July to December, you can claim the other half on your tax return in 2022. If you have opted out of monthly payments or have not yet received monthly payments that qualify for the child discount, you can probably claim the full benefit on your next tax return.

Keep in mind that if you have received monthly payments of the children’s discount and you were not eligible for the benefit, this may increase your tax burden because you are expected to repay that money.

Create a financial plan with Mint

When it comes to the amount of the child tax credit for 2021, the taxpayer will receive a larger benefit than in recent years. This is good news for Americans who need to support families, as they will have a lower tax burden in 2022. However, to get the most out of that extra cash, it’s important to manage it with care.

Use the Mint app to easily and effectively manage your family’s monthly budget. With our app, you can set financial goals, track expenses, and make sure that every dollar you receive from childcare benefit goes a long way toward helping your family. So whether you’re trying to budget for a baby or want access to monthly budget templates, the Mint app will help you achieve all of your personal financial goals.

Download the Mint app and empower yourself to take control of your finances with a handy tool that gives you the easy-to-read financial information you need to make decisions and improve your overall tax well-being.

Sources: Center for Fiscal and Policy Priorities | IRS 1, 2 | White House

Other Family Finance Resources:

Use our financial calculators to plan.

Here are some personal financial tips.

Create a budget for your family in just a few steps.

A few ways to spend your tax refund wisely.

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top.

Learn more about security

This post How much is the child tax credit for 2021?

was original published at “https://mint.intuit.com/blog/family/child-tax-credit/”