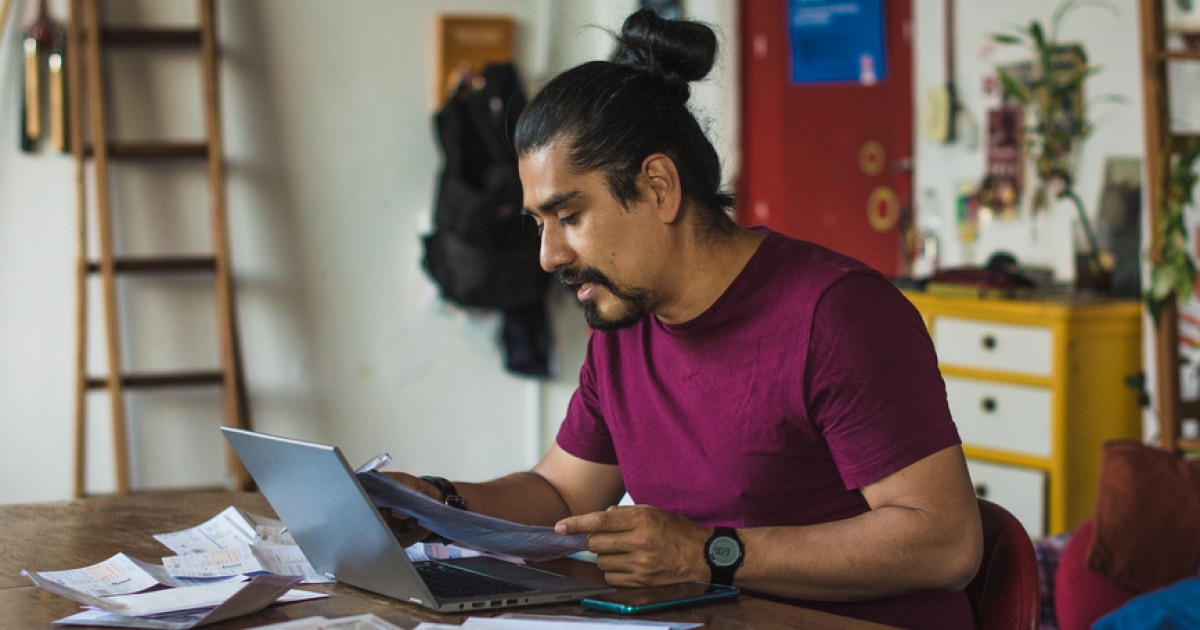

In an effort to fight inflation, the Federal Reserve has raised interest rates by a quarter point to a range of 0.25% to 0.5%. This rate hike, the first since 2018, is one of seven planned rate hikes in 2022.

What does that actually mean for your finances? Let’s take a look at how this turn of events can affect your financial situation and investment strategy.

How an interest rate hike will affect your finances

When the Federal Reserve raises interest rates, banks and lenders react in turn. Here you may see higher rates:

credit cards

Credit card interest rates often change based on what’s happening in the market. And if the Fed raises interest rates, credit card providers are likely to raise their rates in return. However, this only affects consumers who have a credit card balance. If you have a credit card and pay off your balance every month, nothing really changes for you.

But if you have credit card debt, you may owe more interest each month until you can pay off the balance.

To reduce this increase, you can transfer debt to a balance transfer card with a special 0% APR offer. These offers usually last between 12 and 24 months, depending on the card provider.

During that period, you will not pay any interest on the balance as long as you pay the minimum amount each month. If you can try to pay off all or most of the balance before the 0% APR offer expires, you can save hundreds in total interest. Most card companies charge a 3% transfer fee, so make sure you can pay off most of the balance or you won’t end up saving much money.

If you don’t qualify for a 0% APR offer, you can also call the credit card provider and ask them for a lower interest rate. Remind the card provider that you have been a responsible customer and ask if they can lower your interest rate. Repeat this process for each card you have a balance with.

Savings account

The interest on a savings account depends on external market factors. When the Covid-19 pandemic started and the Federal Reserve cut interest rates, rates on savings also fell. Now that the Federal Reserve is raising interest rates, you may notice that the interest on your savings account is also going up.

The difference may be minimal, as the Fed is not raising interest rates substantially. Keep an eye on your savings account over the next few months and see if your rate changes.

Banks raise savings rates on their own schedule. If you don’t notice a change in your savings account, check with competing banks and see if their rates are higher. If so, it may be worth transferring your funds and opening a new account.

Loans with variable interest

A floating rate loan is a loan with an interest rate that changes over the life of the loan. There are many types of loans that can have variable interest rates, including mortgages, personal loans, student loans, car loans, and more.

When the Federal Reserve raises interest rates, lenders will also raise the interest on a variable-rate loan. The increase cannot happen immediately, depending on the conditions of your loan. For example, some lenders only change the interest rate once a year, while others change it quarterly or even once a month.

If you are not sure if you have a variable rate loan, contact your lender’s customer service and ask. You can also view your original loan documents, which will tell you what type of interest you have.

If you do have a variable rate loan, you can also contact the lender and ask when your interest rate changes and what the new rate will be. Knowing this in advance will help you budget the increase.

If you can’t afford the price increase, consider refinancing the loan at a fixed rate. If you really want a lower monthly payment, then opt for a loan with a longer term when refinancing in order to ultimately receive lower monthly payments.

Interest rates for new loans

If you’ve been thinking about applying for a loan, such as a mortgage, personal loan, or car loan, you may be paying a higher interest now than you would have applied a month ago. Borrowers who already have loans will also see higher interest rates if they try to refinance now.

However, interest rates are still relatively low, even if they are not as low as they were a month ago. And the rates will only increase in the future. If you’ve been thinking about taking out a new loan or refinancing an existing one, it might be better to act now rather than wait for interest rates to drop again.

investments

Rising interest rates may or may not correlate with a rise in the stock market and other investments. That’s because the stock market is influenced by many other factors, including unemployment rates, current events, the economic forecast, and more.

In general, if the Fed raises interest rates, it could be a sign that the economy is improving. This could lead to another rise in the stock market. But the Russian invasion of Ukraine has had a significant negative effect on the stock market, so it’s hard to say what effect higher interest rates will have.

Remember, you shouldn’t feel the need to change your investment approach based on rising interest rates. Keep your strategy the same and talk to a financial planner if you’re concerned.

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top.

Learn more about security

![]()

Zina Kumok (167 posts)

Zina Kumok is a freelance writer specializing in personal finance. As a former reporter, she has covered murder trials, the Final Four, and everything in between. She was featured in Lifehacker, DailyWorth and Time. Learn how she paid off $28,000 in student loans over three years at Conscious Coins.

Left

This post Here’s what you need to know about rising interest rates

was original published at “https://mint.intuit.com/blog/inflation/interest-rates-going-up/”