Links to breadcrumbs

Personal Finance

RRSP contributions can significantly lower your total taxable income in the tax return year and increase your retirement savings

Publication date:

February 17, 2022 • February 17, 2022 • 3 minute read • 6 Responses  Investment portfolios grow tax-free as they are invested within the RRSP, and the rate-increasing effect becomes even greater over a longer time horizon. Photo by Brent Lewin/Bloomberg

Investment portfolios grow tax-free as they are invested within the RRSP, and the rate-increasing effect becomes even greater over a longer time horizon. Photo by Brent Lewin/Bloomberg

Reviews and recommendations are unbiased and products are selected independently. Postmedia may earn an affiliate commission for purchases made through links on this page.

Article content

This is always an exciting time of year for financial geeks like me or those who get excited about things like updating spreadsheets. You see, I’m a fan of Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), and all the other tax-deferred, tax-protected vehicles because one of the certain things in financial planning is that taxes inevitably trend up over time.

Advertisement 2

This ad hasn’t loaded yet, but your article continues below.

Article content

Even though we live in a country with relatively high income taxes, contributing to an RRSP can still be a controversial topic, and from time to time I’ve heard people question the merits of an RRSP. Here are some of their main objections:

Since not all gains in the investment portfolio are fully taxable, such as capital gains, does it make sense to put money into an RRSP so that all withdrawals are fully taxed as regular income?

When you retire, it can be heartbreaking to see some of your hard-earned retirement income go down with a withholding tax.

But consider this:

RRSP contributions can significantly lower your total taxable income in the tax return year and improve your retirement savings;

Investment portfolios grow tax-free as they are invested within the RRSP, and the rate-increasing effect becomes even greater over a longer time horizon;

Advertisement 3

This ad hasn’t loaded yet, but your article continues below.

Article content

The difference between current and future tax brackets matters. With proper planning, total taxable income at retirement should be less than your peak income years;

And having a diversified set of income streams to draw from in retirement can maximize flexibility and tax efficiency.

FP Answers: Can I retire on $48,000 a year at age 43?

FP Answers: Should I invest in a TFSA or RRSP? And when does it make sense to do both?

Four key things to consider if you’re planning to retire this year

FP Answers: When is the best time to make my last RRSP contribution?

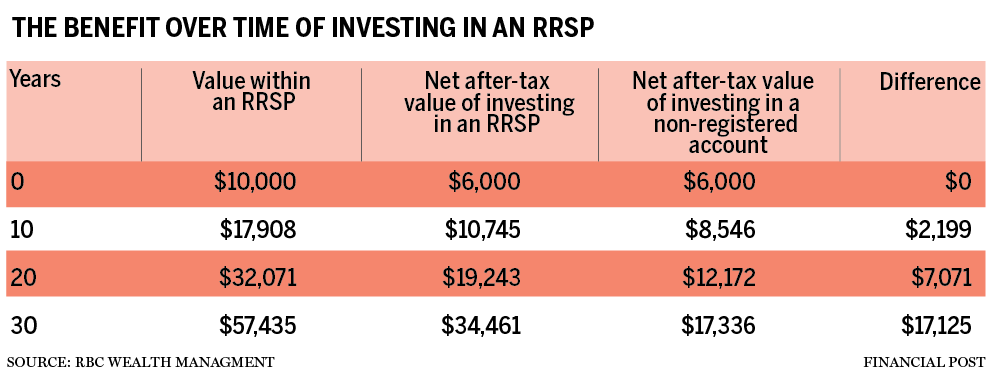

Let’s look at a numerical example of investing in RRSPs versus an unregistered account. We’ll keep the assumptions simple. The investment has an annual return of six percent in interest income, and you have a marginal tax rate of 40 percent each year.

Advertisement 4

This ad hasn’t loaded yet, but your article continues below.

Article content

Since contributions to your RRSP are actually made with pre-tax dollars and contributions to your unrecorded account are made with after-tax dollars, we also assume that you have $10,000 to invest in your RRSP and $6,000 ($ 10,000 x 60 percent) after-tax funds to invest in your unregistered account.

Finally, for a simplified, but complete, after-tax net rate comparison, the example assumes you withdraw the full amount of your RRSP and pay tax at your marginal tax rate of 40 percent on the 10, 20, and 30 year marks.

We have kept the assumptions conservative, but the accompanying table shows that we were still able to demonstrate a net benefit from investing in an RRSP.

convinced? Here are three helpful tips to help you get the most out of your RRSPs.

Advertisement 5

This ad hasn’t loaded yet, but your article continues below.

Article content

You can contribute as early as the first day of the year and claim your contribution when you’re ready to file your tax return.

RRSP contributions are used to reduce your total taxable income for the year. An abbreviation for calculating your tax refund is to multiply the approximate dollar amount contributed by your marginal tax rate.

You can borrow to contribute to your RRSP, but whether you should really do so depends on your tax bracket and individual situation. Given today’s low interest rates, borrowing to invest can be beneficial, but leverage should be used with caution and only after careful consideration of your financial situation and overall financial plan.

Have fun saving and investing.

Rita Li is an investment advisor at RBC Dominion Securities, RBC Asset Management†

†

Sign up for the FP Investor newsletter for more stories like this.

†

Share this article in your social network

Advertisement

This ad hasn’t loaded yet, but your article continues below.

Top Financial Messaging Stories

By clicking the sign up button, you agree to receive the above newsletter from Postmedia Network Inc. receive. You can unsubscribe at any time by clicking the unsubscribe link at the bottom of our emails. Postmedia Network Inc. † 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Thanks for signing up!

Comments

Postmedia is committed to maintaining a lively yet civilized discussion forum and encourages all readers to share their thoughts on our articles. It can take up to an hour for comments to be moderated before appearing on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email when you get a reply to your comment, there’s an update to a comment thread you’re following, or a user follows comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

This post Is it worth investing in an RRSP? Here’s the math

was original published at “https://financialpost.com/personal-finance/does-it-pay-to-invest-in-an-rrsp-heres-the-math”