When it comes to paying for college, most people think the only option is to take out mountains of student loans.

Student loans are a source of funding for most students, but they should really be your last option. Student loans yield a lot of interest and take years to pay off. A study by the OneWisconsin Institute found that it takes college graduates in Wisconsin 19.7 years to pay off a bachelor’s degree and 23 years to pay off a diploma.

Knowing that student loans are likely to be a source of funding, there is still a sequence of operations to follow when looking for funding sources for college. After reviewing your notification of the financial aid award, you should think about how you will pay for school.

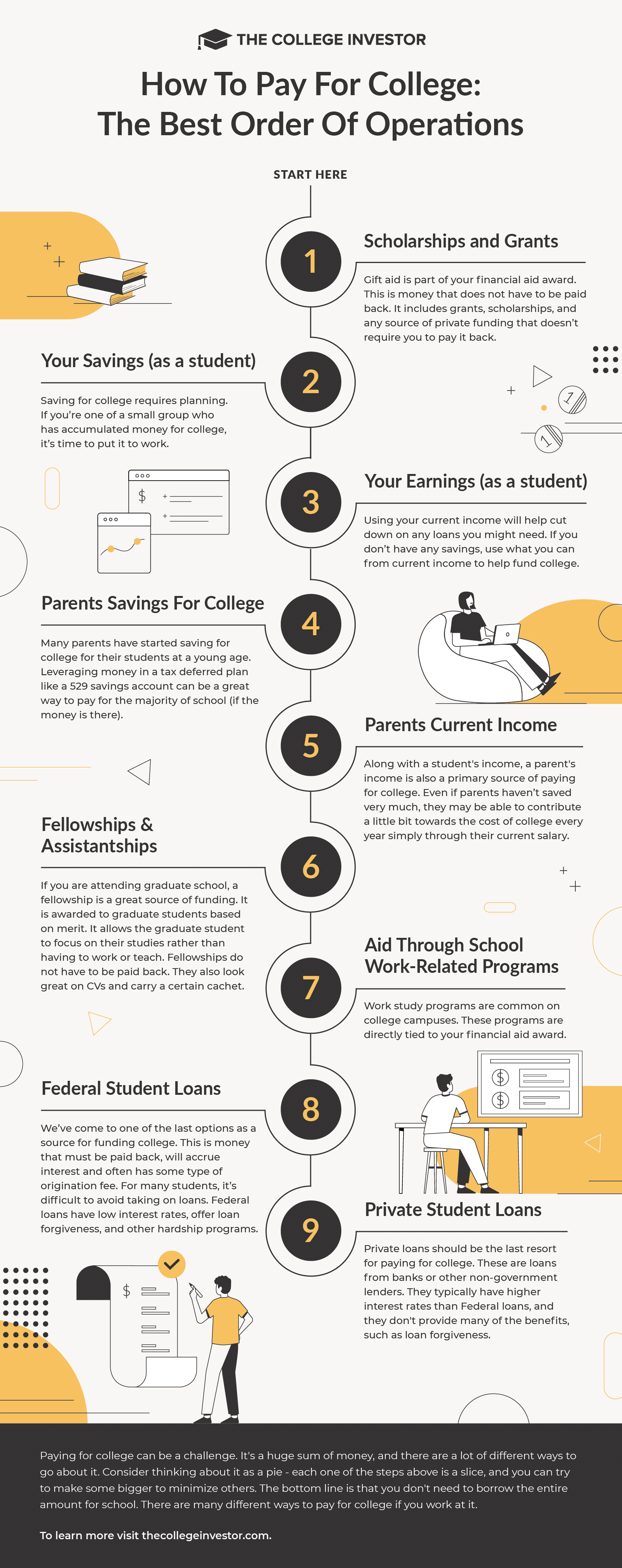

In this article, we’ve listed the main groups of funding sources. Start with the top group and work your way up to the last (i.e., worse) option, which is student loans. By following this guide, there is a chance that you will be able to reduce the amount of student loans needed to fund college. For a lucky few, they may not even find student loans necessary.

Here’s our take on the “best” order of surgery to pay for college. It’s important to note that this is more of a “pie” than a strict sequence. The more you can contribute from the “former” tranches, the less you have to borrow. And there are no “strict” rules here – but you should definitely use free money for other funds.

How to pay for college? [Order of Operations]

1. Scholarships and Scholarships

Gift help is part of your financial support. This is money that does not need to be repaid. It includes grants, grants, and any source of private funding that doesn’t require you to repay it.

It depends, of course, on whether your FAFSA is filed on time.

Some students can realize a large number of scholarships and grants. Others may not be able to get that much.

Don’t forget to apply for private grants and grants as well – don’t rely solely on your school. This sounds crazy, but I recommend high school students to apply for a minimum of 50 scholarships.

For your convenience, we also have this guide to state scholarships and grants.

Check out these guides:

2. Your own savings (as a student)

Saving for college requires planning. If you’re one of a small group that’s been raising money for college, it’s time to put it to work.

You may have saved up your graduation money, or received birthday money over time. Maybe grandma even left you some money to go to college when you were younger.

If you have your own student savings, using it to pay for college is a great first step.

3. Your earnings (as a student)

In addition, using your current income will help reduce any borrowing. If you don’t have any savings, use what you can of current income to fund college.

Many people forget that they can earn money before going to school (ie the best summer jobs for students), or even work full-time during school.

I personally worked full time while attending college. I worked five days a week – Monday, Wednesday and Friday evenings, and Saturday and Sunday during the day. I tried to schedule my classes for Tuesday and Thursday, or if necessary, for work on the other days.

Not sure how to earn money as a student? Check out our 100+ ways to make money in college.

4. Savings for Parents for College

Next on the list is all the money your parents set aside for school. This can be in the form of a 529 college savings account or other savings account.

Many parents have already started saving for the studies of their students at a young age. Using money in a tax-deferred plan like a 529 savings account can be a great way to pay for most of the school (if the money is there).

Parents can also set aside other savings for their child. It’s important to have conversations about parent contributions early so that everyone involved in the “pay for college” debate knows what to expect.

5. Current Income Parents

In addition to a student’s income, a parent’s income is also a primary source of payment for college. Even if parents have a lot of savings, they may be able to contribute a small amount to college costs each year simply through their current salary.

Some parents may be able to contribute a lot more than others, but every little bit that can be donated to avoid having to borrow for school is a huge win.

Note: Some states allow tax deductions or tax credits for 529 plan contributions. You can contribute and withdraw in the same year in most states, making it potentially worth using your current income to contribute to a 529 plan, and pay for college from there.

See our guide: 529 Plan Rules by State.

6. Scholarships and Assistantships

If you’re going to graduate school, a fellowship is a great source of funding. It is awarded to graduate students on the basis of merit. It allows the graduate student to focus on their studies rather than having to work or teach. Scholarships do not have to be repaid. They also look great on resumes and have a certain cachet.

“It’s basically the Harry Potter scar on your forehead that shows you’re a great scholar,” said Meredith Drake Reitan, associate dean for graduate fellowships at the USC Graduate School.

“The fellowship program is about research potential,” she said. “Faculty members might say, ‘They’re not ready to apply for the NSF Fellowship yet because their research isn’t quite up to scratch yet.’ But that’s actually exactly where the NSF wants them — it’s designed to be an early career accelerator.

The takeaway: Don’t think you’re not qualified for a fellowship. They are definitely worth applying for. Talk to your educational advisor or counselor about how and which ones have the greatest potential for successful adoption.

7. Help through Schoolwork Related Programs

Continuing down the list, we get to work-related programs that aim to provide a flexible schedule around your classes. At this point, you have exhausted all forms of financing that do not require a work exchange or loans. We are now moving to sources of funding that have to be recouped in some way.

Work studies are common on college campuses. These programs are usually linked to your financial aid. They allow you to work on campus within a flexible schedule. The pay is usually minimum wage, but you can’t beat the flexible schedule of these programs. While it’s a smaller source of funding, depending on your class schedule, it may be the only kind of job you can take.

Assistantships are usually reserved for graduate students. These programs are similar to work studies except they are teaching positions. Often the student will teach at a lower level in areas they are well versed in.

Check out our guide to federal work study programs.

8. Federal Student Loans

We have come to one of the latter options as a source of funding for the university. This is money that has to be repaid, accrues interest and often has some sort of origination fee. For many students it is difficult to avoid loans.

Federal loans have fairly low interest rates, often no higher than the single digits. As reported by StudentAid.ed.gov, loans first disbursed on or after July 1, 2021 and before July 1, 2022 will have the following interest rates:

Direct Grant (undergraduate): 3.734%Direct Non-Grant (undergraduate): 3.734%Direct Non-Grant (graduate or professional): 5.284%Direct PLUS: (parents and graduate or professional students): 6.284%

With regard to college loans, you probably won’t find a better deal anywhere else.

Don’t believe us? View the best student loans here.

If you need a student loan, here is the process for applying for a student loan (both federal and private).

9. Private Student Loans

Private loans are another and final option. These can be loans from banks or other non-government lenders. They typically have higher interest rates than government bonds and don’t offer the same benefits as loan forgiveness, hardships, and flexible repayment plans.

Private student loans really should be a last resort, and before borrowing you really should do a full Return On Investment calculation of your college costs to even see if college is worth it.

We recommend that students shop and compare private loans before taking out. Credible is an excellent choice because in 2 minutes you can compare about 10 different lenders and see what you qualify for. View Credible here.

You can also check out the full list of private student loan options here: Best Private Student Loans.

infographic

If you agree with this order of edits, share this helpful infographic with your friends and family who need to know:

Final Thoughts

Paying for college can be a challenge. It’s a huge sum of money, and there are many different ways to go about it.

I like to think of it as a pie – each of the steps above is a slice, and you can try making some bigger to minimize others.

The bottom line is that you don’t have to borrow the entire amount for school. There are many different ways to pay for school when you work on it.

This post How to pay for college?

was original published at “https://thecollegeinvestor.com/21877/pay-for-college/”