During the payment break and interest waiver, borrowers of eligible federal student loans were not required to make payments on their federal student loans. Since no new interest accrued, any payments would only be applied to the principal balance of the loans.

Should you have paid off your loans during the payment break or should you have invested your loan?

In hindsight is 20/20. But you still have a few months before the payment break and interest exemption ends. Also, the most recent extension may not be the latest extension.

What is the payment break and interest exemption?

The payment pause and interest waiver, which began in March 2020, suspended repayment of eligible federal education loans for more than two years during the Covid-19 pandemic. Interest has also been temporarily set to zero. All collection activities on defaulted federal loans were also suspended.

Eligible loans include all federal student loans from the United States Department of Education. This includes all loans in the Direct Loan program, certain loans made in the Federal Family Education Loan Program (FFELP) under the Ensuring Continued Access to Student Loans Act (ECASLA), defaulting FFELP loans held by guarantee agencies on behalf of the United States Department of Education and federal Perkins loans assigned by colleges to the United States Department of Education.

Commercial FFELP loans and private student loans are not eligible for the payment break and interest waiver. Commercially held FFELP loans may qualify by including them in a Federal Direct Consolidation Loan.

Aside from spending the money, borrowers have a few options for using the money they would otherwise have had to spend paying off their student loans.

Build or build an emergency fund Continue to pay off the interrupted federal student loans Pay off other higher-interest debts Invest the money

Let’s take a look at the financial impact of these options.

Option 1: Build or accumulate an emergency fund

There was record unemployment during the pandemic, even among highly skilled workers. However, unemployment rates have now normalized and reached pre-pandemic levels.

You may still have your job, but who knows what could happen in a month or two?

It’s a good idea to have an emergency fund with half a year’s salary, to survive a spell of unemployment or pay for other unexpected expenses. The average unemployment period during an economic downturn is just over five months, so half a year’s salary should be enough to cover living expenses, especially if you’re cutting back to further expand the emergency fund. (Unemployment benefits can help, but are usually anemic, averaging about the same as the poverty line for a family of four.)

Assuming your student debt is in sync with your income and you’re on a standard 10-year repayment plan, you could have saved about a quarter of your annual salary during the two years of the payment break and interest exemption. If you had an extended repayment plan with a 30-year term, you might have saved half as much by transferring student loan payments to your emergency fund.

You should not make additional payments on loans or invest additional money until you have built up an adequate emergency fund.

Option 2: Pay off your student loans

Of the borrowers who qualified for the payment break and interest waiver, only 1.2% continued to make payments on their federal student loans. The full payment was applied to the principal of the loan, as the interest was temporarily at zero and thus no new interest was accruing.

Since interest represents as much as half of the average loan payment, continuing to pay during the two years of the payment break and interest exemption would have paid off the principal with as much as an additional year in payments, for a total of three years of progress in paying off. debt.

Consider a $30,000 student loan with a 5% interest rate and a 10-year repayment term. The monthly payment is $318.20. Two-year payments total $7,646.80. Applying this in full to the principal balance of the loan, the loan balance is reduced to $22,363.20. That’s about the same as the loan balance of a regularly amortized loan after 36 payments.

Of course, borrowers pursuing Public Service Loan Forgiveness (PSLF) or the 20- or 25-year forgiveness at the end of an income-driven repayment plan are not allowed to make payments on their federal student loans when they are not required to do so. Making these payments only serves to reduce the amount of forgiveness the borrower will ultimately receive. In addition, the interrupted payments count toward forgiveness as if they were made, so making the payments does not provide additional progress toward loan forgiveness.

Option 3: Pay off higher interest debt

Federal student loans have some of the lowest fixed interest rates on unsecured debt.

If you’re going to pay off debt, it’s best to pay off debts that charge a higher interest rate, such as private student loans or credit card debt.

Paying off debt is like getting a return on investment equal to the interest charged by the debt, tax-free as you no longer have to pay interest on the amount of the additional payment.

If you pay off debt that costs twice the interest, you double the savings.

Option 4: Invest the money

Investing the money in the stock market can provide a higher return on your investment, albeit with a higher risk, than paying off debt.

While the S&P 500 is up about 75% from March 2020 to February 2022, the actual return on investment is slightly lower because the interrupted student loan payments would have been invested monthly rather than in a lump sum. Assuming equal amounts were invested on the first trading day of the month from April 2020 to January 2022, the total return on investment would have been approximately 23%. That’s a better return on investment than paying off student loans.

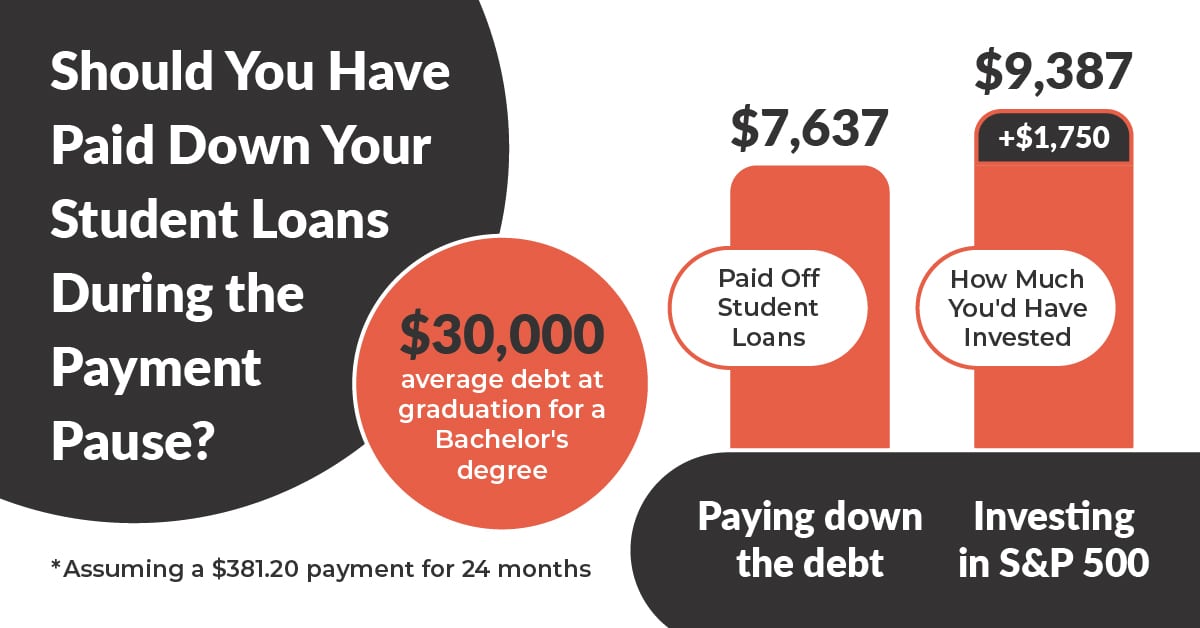

Using the example above, if you have $30,000 (average debt at graduation for a bachelor’s degree) at 5% interest, your monthly payment would be about $318.20 per month. Paying off the debt over 24 months would reduce it by $7,636.80.

However, if you had invested that $318.20 per month in the S&P 500, you would have seen it grow to $9,387. That is about € 1,750 difference. You can then take that same $9,387 and pay off your debt, or grow it in the future.

However, investing in the stock market is much riskier than paying off debt. Paying off debts is risk-free. On the other hand, you can lose money by investing in the stock market.

The stock market has become much more volatile since the fall of 2021, partly due to measures by the Federal Reserve Board to raise interest rates, concerns about the Omicron variant of the Covid-19 virus and concerns about the war in Ukraine. Investing in the stock market is not guaranteed to yield as much as paying off debt.

This post Should you have paid your student loans during the payment break?

was original published at “https://thecollegeinvestor.com/39524/paid-down-your-student-loans-payment-pause/”